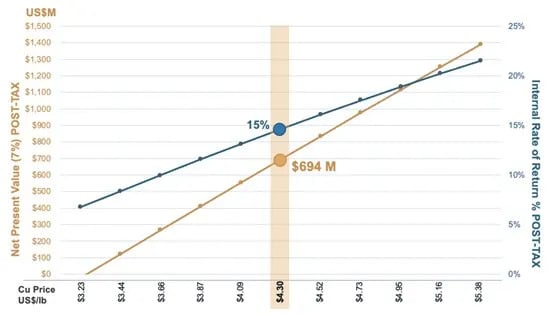

Base Case $4.30/lb copper, Post-Tax NPV (7%) $694 million and 14.6% IRR with payback at 6.7 years

Advancing Clear Path to Near-Term Production of U.S. Refined Copper Cathode

Yerington, Nevada–(Newsfile Corp. – August 5, 2025) – Lion Copper and Gold Corp. (CSE: LEO) (OTCQB: LCGMF) (“Lion Copper and Gold” or the “Company“) is pleased to announce the results of the Pre-Feasibility Study (PFS) for its wholly-owned Yerington Copper Project, located in Lyon County, Nevada. The PFS, completed pursuant to the provisions of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), demonstrates and confirms the Project’s potential as a significant refined copper cathode producer in the United States in the heart of the Yerington Copper District. The PFS was prepared by Samuel Engineering Inc., with input from independent Qualified Persons (QPs), and was fully funded by the Company’s strategic partner, Nuton LLC, a Rio Tinto venture.

In this news release, all dollar amounts are in United States dollars (“$”) and imperial units are utilized.

Highlights

Sizeable and scalable open pit heap leach project

- Average annual production of 120 million pounds of refined copper cathode over a 12-year mine life, with a peak of 151 million pounds in Years 5-7.

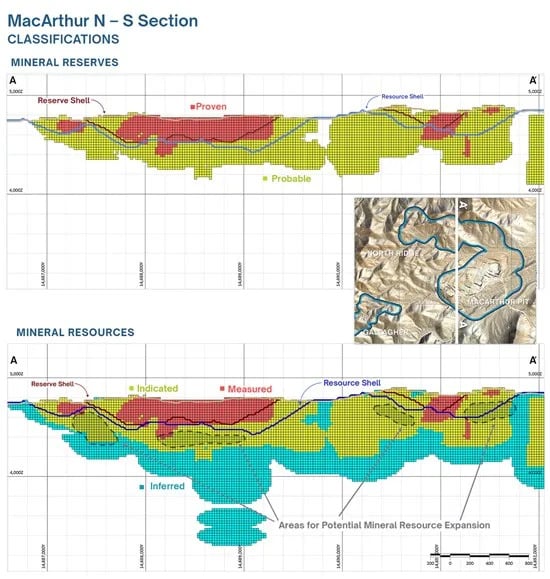

- Proven and Probable Reserves of 506.5 million tons at 0.21% CuT, containing 2.14 billion pounds of copper.

- Excluding reserves, an additional Measured & Indicated Resource of 293.3 million tons at 0.18% CuT, containing 989 million pounds of copper and an additional Inferred Resource of 158.1 million tons at 0.14% CuT, containing 443.4 million pounds of copper.

- Strong copper recovery performance with an average of 67.4% LOM copper recovery from low-cost heap leaching – 73.2% copper recovery from sulfides using Nuton leach technology and 60% from oxides in a conventional heap leach.

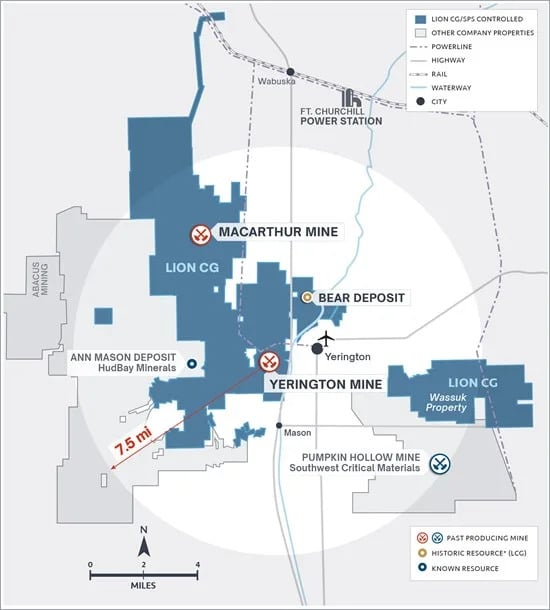

- Extensive land holdings include patented and unpatented mining claims as well as private land adjacent to other significant copper deposits.

- The Project plans to spend approximately $70M to treat 43,000 acre-feet of Yerington Pit Lake water and release this water to the environment for multiple beneficial stakeholder uses in the Mason Valley.

- Benefits of the Project include utilizing disturbed land for mine infrastructure, zero discharge of water from copper processing operations, lower carbon intensity, and efficiently delivering copper cathode directly into U.S. supply chains.

John Banning, CEO of the Company, states, “With growing domestic demand for refined copper, we are pleased to announce the completion of the Pre-Feasibility Study for our Yerington Copper Project, a brownfield asset in Nevada, planned to produce 120 million pounds of refined copper cathode annually over a 12-year mine life. This PFS showcases Lion Copper and Gold’s strategic advantage in the Yerington Copper District, bolstered by secured water rights, the Bear Deposit’s significant potential, strategic land control, and proximity to major neighboring copper projects, positioning us to deliver significant shareholder value and strengthen North America’s critical minerals supply chain.”

Economics

- Base Case $4.30/lb copper, Post-Tax NPV (7%) $694 million and 14.6% IRR with payback at 6.7 years.

- Initial Capital: $724 million, including mine development, heap leach pads, SX/EW plant, acid plant and related infrastructure.

- Base Case NPV-to-Initial Capital Ratio of 0.96.

- Operating Costs: Cash cost (C1)1 of $1.92 per pound of copper.

- All-in Sustaining Costs (AISC)1 of $2.67 per pound of copper.

- Base Case Capital Intensity* of $12,044/tpa.

* Initial capital expenditures divided by average annual copper production for mine life

Copper Price Sensitivity

| Sensitivity | Copper Price | Pre-Tax | Post-Tax | ||||

| (%) /item | Cu/lb | NPV(7%) | IRR | Payback | NPV(7%) | IRR | Payback |

| $M | % | Years | $M | % | Years | ||

| -25% | $3.23 | $111 | 8% | 8.9 | ($21) | 7% | N/A |

| -20% | $3.44 | $284 | 10% | 8.2 | $122 | 8% | 8.6 |

| -15% | $3.66 | $457 | 12% | 7.6 | $266 | 10% | 7.9 |

| -10% | $3.87 | $629 | 14% | 7.1 | $410 | 12% | 7.4 |

| -5% | $4.09 | $802 | 15% | 6.7 | $553 | 13% | 7.0 |

| Base Case | $4.30 | $975 | 17% | 6.4 | $694 | 15% | 6.7 |

| 5% | $4.52 | $1,148 | 19% | 6.1 | $836 | 16% | 6.4 |

| 10% | $4.73 | $1,321 | 20% | 5.8 | $976 | 18% | 6.1 |

| 15% | $4.95 | $1,494 | 22% | 5.5 | $1,116 | 19% | 5.9 |

| 20% | $5.16 | $1,667 | 23% | 5.3 | $1,254 | 20% | 5.6 |

| 25% | $5.38 | $1,840 | 25% | 5.0 | $1,390 | 22% | 5.4 |

Figure 1. Copper Price Sensitivity After Tax

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_001full.jpg

Significantly Derisked Project at PFS level with Resource Upside Potential

- Strong reserve and resource confidence with 60% of the resources in Proven and Probable and 88% Measured and Indicated categories with over 125 miles (660,000 ft) of drilling in 1,662 drill holes across the Yerington and MacArthur deposits.

- +10 years of extensive metallurgical testwork and modelling completed including over 50 column tests thoroughly assessing performance characteristics across numerous composites and configurations to optimize reliable metallurgical outcomes.

- 6,014 acre-feet/year of secured water rights permitted for mining use for the life of the project.

- Regional infrastructure is in place to support a major mine, with rail, power, highway, airport and proximity to skilled workforce.

- Clear path to permitting with strong eligibility potential for Fast-41 streamlined permitting process.

Strategically Important U.S. Copper Production

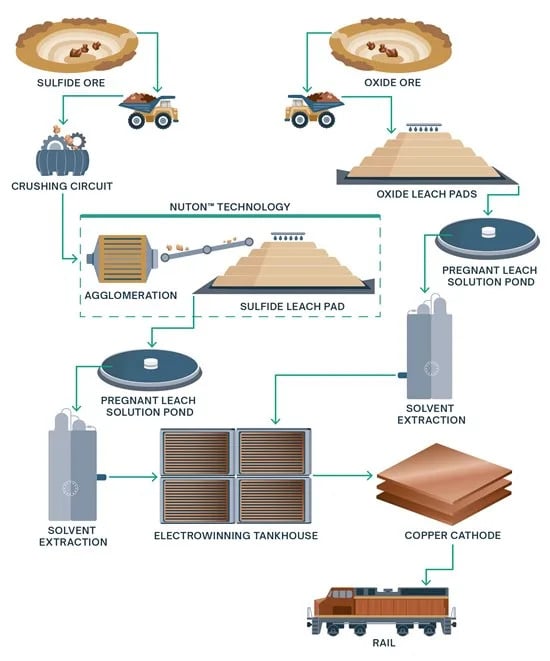

- Heap leach operation with solvent extraction-electrowinning (SX/EW), enhanced by Nuton’s proprietary sulfide leaching technology, achieving a project average of 73.2% copper recovery from sulfide ore.

- Run of mine (ROM) oxide ore heap leached with recoveries at the project of 60%.

- On-site production of refined cathode copper for use in U.S. supply chains.

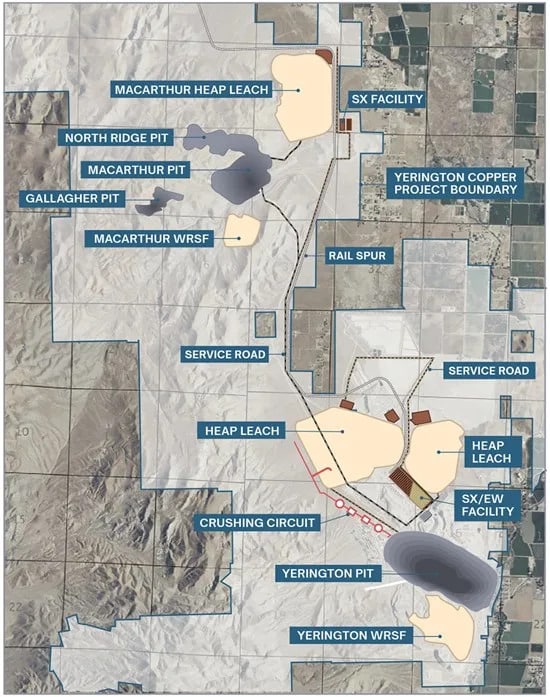

Project Overview

The Yerington Copper Project integrates the Yerington and MacArthur deposits, located in Nevada’s Yerington Copper District, a historic mining region with excellent infrastructure (rail, power, U.S. Highway 95A). The Project benefits from 100% Lion Copper and Gold owned water rights of 6,014 acre-feet/year permitted for mining use for the life of the project and de-risked permitting and mine development. The PFS envisions conventional open-pit mines feeding a heap leach operation, producing LME Grade A copper cathode via SX/EW, with Nuton’s technology enhancing sulfide recoveries. The Project plans to create approximately 400 direct jobs during construction and up to 250 permanent jobs during operations, contributing significantly to the local and state economies.

The Project offers significant environmental benefits compared to traditional copper production. Benefits of the Project include utilizing previously disturbed project facilities area suitable for new mine infrastructure, using pit water for multiple beneficial uses in Mason Valley, zero discharge of water from copper processing operations, lower carbon intensity, and efficiently delivering refined copper cathode directly into U.S. supply chains. These environmental benefits are an important part of the Project being a partner in the Mason Valley to foster growth and diversity in the local economy together with the local stakeholders.

The Project is approximately 70 miles by road from Reno, Nevada, 50 miles south of Tahoe-Reno Industrial Center, and 10 miles from the nearest rail spur of Wabuska. The Project includes both the historic Yerington and MacArthur open pit mines with shared mineral processing infrastructure for operational efficiency. The Project is bordered on the east by the town of Yerington, Nevada, which provides access via a network of paved and gravel roads that were used during previous mining operations.

Figure 2. Yerington Copper Project Overview

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_002full.jpg

Base Case Economics – Based on $4.30/lb Copper Price

| Parameter | Unit | Pre-tax | Post-tax |

| Net Revenue | $USM | 2,914 | 2,315 |

| NPV (7%) (LOM) | $USM | $975 | $694 |

| IRR (LOM) | % | 16.9% | 14.6% |

| Payback | Years | 6.4 | 6.7 |

| Cash Costs1 | $US/lb payable | $1.92 | |

| AISC1 | $US/lb payable | $2.67 | |

| Copper – Payable | Mlbs | 1,443 | |

| Mine Life | Years | 12 | |

| Average Annual Production LOM | Mlbs | 120 | |

| LOM Production | tons | 721,352 | |

1 Total cash cost and AISC are non-GAAP measures and include royalties payable. See reference below regarding non-IFRS measures.

NPV Sensitivities

The sensitivity analysis provides a range of results for the Project when key parameters are varied from their base-case values. The NPV estimate is most sensitive to the copper price.

The PFS uses a base case copper price of $4.30/lb, using the COMEX two-year trailing average copper prices. Project sensitivities were completed on the copper price with a range of $3.25/lb through $5.38/lb:

- At $3.23/lb: NPV(7%) -$21M IRR 7% (Post-Tax).

- At $5.38/lb: NPV(7%) $1.4B, IRR 22% (Post-Tax).

Capital and Operating Costs

The initial capital, expensed over the first 3 years of the Project, amounts to $724 million. The sustaining capital over the remainder of LOM amounts to $1,008 million. A breakdown of capital is presented in the tables below.

| Operating Costs | $USM | $/t Feed | $/lb payable |

| Open Pit Mining | 1,698 | 3.35 | 1.18 |

| Processing | 947 | 1.87 | 0.66 |

| G&A | 124 | 0.24 | 0.09 |

| Total | 2,769 | 5.47 | 1.92 |

| Capital Costs | ||

| Initial Capital | $USM | 724 |

| Sustaining Capital | $USM | 1,008 |

| Total Capital | $USM | 1,732 |

| $/lb payable | 1.20 | |

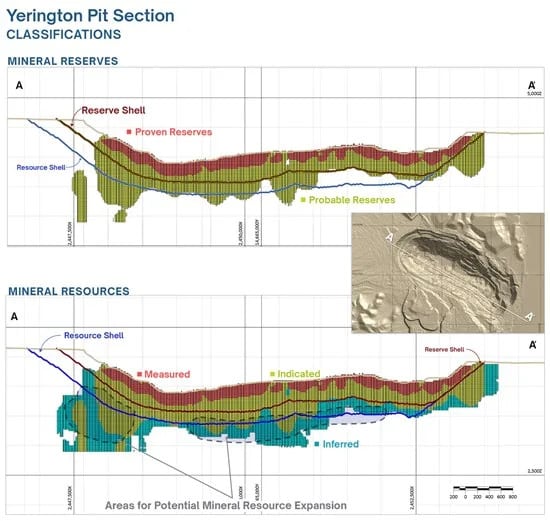

Reserves and Resources

The PFS includes the first Mineral Reserve estimate for the Yerington Copper Project. The PFS is based on the Mineral Reserves only and the reserve estimate is based on pit designs using a copper price of $3.90/lb, with cut-off grades ranging from 0.03 to 0.07% CuT for oxide material and 0.09% CuT for sulfide material.

Mineral Reserves

| Pit Area | Proven | Probable | Total | ||||||

| Ore Type | Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) | Grade (Cu%) | Copper Mlbs |

| Yerington Pit/VLT | |||||||||

| Oxide | 34,295 | 0.22 | 148.3 | 73,681 | 0.13 | 193.1 | 107,976 | 0.16 | 341.5 |

| Sulfide | 81,037 | 0.30 | 481.1 | 152,761 | 0.24 | 732.3 | 233,798 | 0.26 | 1,213.3 |

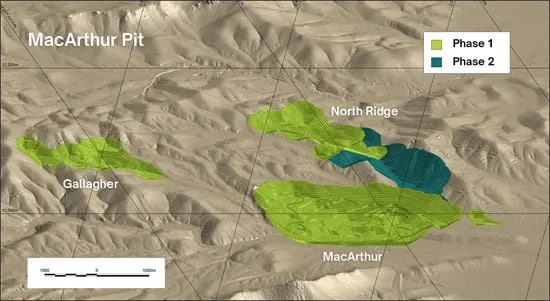

| MacArthur Area | |||||||||

| Oxide | 110,224 | 0.19 | 411.7 | 54,553 | 0.16 | 173.5 | 164,777 | 0.18 | 585.2 |

| Sulfide | – | – | – | – | – | ||||

| Total Oxide | 144,519 | 0.19 | 560.0 | 128,234 | 0.14 | 366.7 | 272,753 | 0.17 | 926.7 |

| Total Sulfide | 81,037 | 0.30 | 481.1 | 152,761 | 0.24 | 732.3 | 233,798 | 0.26 | 1,213.3 |

| Total Reserve | 225,556 | 0.23 | 1,041.1 | 280,995 | 0.20 | 1,099.0 | 506,551 | 0.21 | 2,140.0 |

Note: This Mineral Reserve estimate has an effective date of May 31, 2025, and is based on the mineral resource estimates for Yerington and VLT dated March 17, 2025 by AGP Mining Consultants Inc. and MacArthur Area Pits dated March 17, 2025 by Independent Mining Consultants Inc. The Mineral Reserve estimate was completed under the supervision of Gordon Zurowski, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final pit designs based on a $3.90/lb copper price.

- The copper cutoff grades used were:

Yerington Pit – 0.05% copper (oxide ROM), 0.09% copper (sulfide)

Vat Leach Tailings (VLT) Pit – 0.03% copper (oxide ROM)

MacArthur – 0.05% copper (oxide ROM)

Gallagher Pit – 0.07% copper (oxide ROM)

North Ridge Pit – 0.06% copper (oxide ROM)

- Open pit mining costs varied by area and elevation with waste of $2.53/t, oxide material at $2.49/t and sulfide at $2.22/t. Incremental costs of $0.027/25ft bench were applied below the 4225 foot elevation for waste and oxide and 0.024/t for sulfide material below the 4225 foot elevation.

- Processing costs were based on the use of an acid plant at site with crushing for sulfide material. The processing costs by pit area were:

Yerington Pit – $2.00/t ore (oxide ROM), $4.44/t (sulfide)

VLT Pit – $1.34/t ore (oxide ROM)

MacArthur – $1.67/t ore (oxide ROM)

Gallagher Pit – $2.14/t ore (oxide ROM)

North Ridge Pit – $1.73/t ore (oxide ROM)

G&A costs were $0.49/t ore.

- Process copper recoveries varied by material and area and were as follows:

Yerington Pit – 70% (oxide ROM), 74% (sulfide)

VLT Pit – 75% (oxide ROM)

MacArthur – 55% (oxide ROM)

Gallagher Pit – 54% (oxide ROM)

North Ridge Pit – 55% (oxide ROM)

Mineral Resources (Inclusive of Mineral Reserves)

| Pit Area | Measured | Indicated | Measured + Indicated | ||||||

| Resource Type | Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) | Grade (Cu%) | Copper Mlbs | Tons (kt) | Grade (Cu%) | Copper Mlbs |

| Yerington Pit/VLT | |||||||||

| Oxide | 37,531 | 0.21 | 157.6 | 96,556 | 0.13 | 257.9 | 134,087 | 0.16 | 417.0 |

| Sulfide | 84,163 | 0.30 | 505.0 | 263,230 | 0.22 | 1,158.2 | 347,393 | 0.24 | 1,663.2 |

| MacArthur Area | |||||||||

| Oxide | 163,333 | 0.18 | 577.8 | 155,086 | 0.15 | 471.6 | 318,419 | 0.17 | 1,049.4 |

| Sulfide | – | – | – | – | – | – | – | – | – |

| Total | |||||||||

| Oxide Total | 200,864 | 0.19 | 735.4 | 251,642 | 0.15 | 729.4 | 452,506 | 0.16 | 1,464.9 |

| Sulfide Total | 84,163 | 0.30 | 505.0 | 263,230 | 0.22 | 1,158.2 | 347,393 | 0.24 | 1,663.2 |

| Total | 285,027 | 0.22 | 1,240.4 | 514,872 | 0.18 | 1,887.6 | 799,899 | 0.20 | 3,129.0 |

| Pit Area | Inferred | ||

| Resource Type | Tons (kt) | Grade (Cu %) | Copper Mlbs |

| Yerington Pit/VLT | |||

| Oxide | 67,338 | 0.11 | 145.8 |

| Sulfide | 67,576 | 0.17 | 229.8 |

| MacArthur Area | |||

| Oxide | 23,169 | 0.15 | 67.9 |

| Sulfide | – | – | – |

| Total | |||

| Oxide Total | 90,507 | 0.12 | 213.6 |

| Sulfide Total | 67,576 | 0.17 | 229.8 |

| Total | 158,083 | 0.14 | 443.4 |

Notes:

- Mineral Resources are reported in situ for the Yerington Pit and MacArthur Pit area and the effective date is March 17, 2025. Mineral Resources for the VLT are surficial and the effective date is March 17, 2025. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resource estimate will be converted into Mineral Reserves. The Mineral Resource Estimate of Yerington and the VLT was performed by Mr. Tim Maunula, P. Geo of T. Maunula & Associates Consulting and the MacArthur Area Pits by Mr. Herb Welhener, MMSA-QPM, Vice President of Independent Mining Consultants Inc. Both responsible parties are both Qualified Persons under 43-101 standards. All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Mineral Resources of the Yerington pit area are reported within a conceptual pit shell that used the following input parameters: a variable break-even economic cut-off grade of 0.04 % TCu and 0.08% TCu, for oxide and sulfide material respectively, based on assumptions of a net copper price of US$4.22 per pound (after smelting, refining, transportation, and royalty charges), 70% recovery in oxide material, 74% recovery in sulfide material, base mining costs of $2.49/st for oxide and $2.22/st for sulfide, and processing plus G&A costs of $2.00/st for oxide and $4.44/st for sulfide.

- Mineral Resources of the VLT are reported within a conceptual pit shell that used the following input parameters: a break-even cut-off grade of 0.03 % TCu based on assumptions of a net copper price of US$4.22 per pound (after smelting, refining, transportation and royalty charges) and 75% recovery in oxide material.

- Mineral Resources of the MacArthur Pit area are reported within a conceptual pit shell that used the following input parameters: a break-even cut-off grade of 0.05 % for the MacArthur pit, 0.07 % TCu for the Gallagher pit, and 0.06 % TCu for the North Ridge pit. Metal price of $4.22 per pound (after smelting, refining, transportation, and royalty charges); process costs between $1.67 and $2.14/st; and base mining costs for heap tonnage of $2.49/st and $2.53/st for waste,

- Recovery of Total Copper in redox zones of leach cap, overburden, oxide and mixed: MacArthur domain 55%, North Ridge domain 53%, Gallagher domain 54%.

Figure 3. Yerington Pit Long Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_003full.jpg

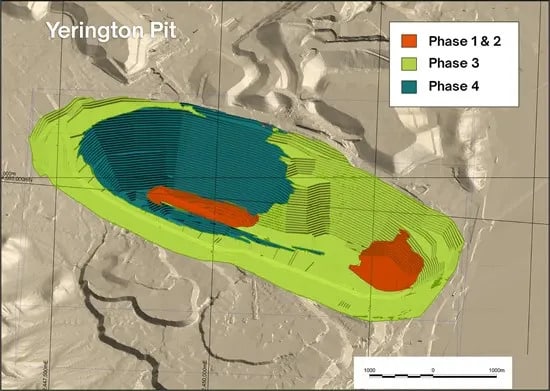

Figure 4. Yerington Pit Mine Phases

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_004full.jpg

Figure 5. MacArthur Pit North-South Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_005full.jpg

Figure 6. MacArthur Pit Mine Phases

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_006full.jpg

Metallurgy

Nuton™ Technology will be utilized for copper recovery in the form of bioleaching for the Yerington Sulfide Ore. Nuton technology will utilize microorganism assisted acid leach system to extract the copper from the Yerington Sulfide Ore that has been crushed and stacked onto a heap leach pad. Pyrite and Nuton additives will be added to the process at the agglomeration stage to enhance the extraction process. This innovative approach has been demonstrated via extensive column testing, lab testing and modelling to enhance the overall copper recovery for the sulfide ore, offering a lower cost and more water efficient sulfide copper recovery process compared to conventional milling and floatation.

Lion Copper and Gold in partnership with Nuton™ completed extensive column and laboratory testing on the Yerington sulfide material to optimize recoveries from deploying the Nuton sulfide leaching technology. Over 40 test columns were leached by Nuton at their own laboratory to develop both recovery models and fine tune process design criteria. The forthcoming PFS Technical Report will provide additional testwork details and associated results.

Process Description Summary

Copper will be extracted through a heap leach process, followed by SX/EW. Ore will originate from multiple sources which will be stacked and processed on three separate leach pads with two SX circuits. The sulfide and oxide ore from the Yerington open pit will be distributed onto separate heap leach pads but will share an SX circuit. The MacArthur open pits will have one heap leach pad and one SX circuit. There will be a single EW facility for the project co-located with the Yerington SX system.

The Yerington Oxide Heap Leach Facility (HLF) will be ROM truck dumped with a peak placement rate of 83,000 short tons per day (tpd) of new oxide ore and residual stockpiled ore. The crushing, conveying, agglomeration and ore stacking at the Yerington Sulfide HLF is designed for 114,000 tpd to process the peak sulfide ore placement rate of 94,000 tpd. The MacArthur HLF will also be ROM truck dump with a peak placement rate of 142,000 tpd.

The Yerington solvent extraction (SX) systems will handle up to 30,000 gallons per minute (gpm) of pregnant leach solution (PLS). MacArthur’s SX system will be designed to process up to 22,000 gpm of PLS. The shared electrowinning (EW) circuit will process electrolyte from both Yerington and MacArthur with the ability to produce up to 90,000 tons per year of refined copper cathode.

The planned mine life is 12 years, with SX/EW to be in operation for 14 years with the acid plants to be in operation for their life cycle of 19 years. Sulfuric acid production that exceeds project requirements will be sold into the domestic market. The combined copper recovery is expected to be 67.4%.

Figure 7. Yerington Copper Project Copper Cathode Production Simplified Flowsheet

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_007full.jpg

Project Development

Lion Copper and Gold anticipates securing all required permits and authorizations needed to construct and operate the Project within reasonable and normal timeframes. Preliminary permitting schedule estimates that the completion of baseline studies, acquisition of requisite state permits, and the National Environmental Policy Act (NEPA) process necessary for project authorization could be completed in as little as 2.5 years. Furthermore, the Project’s permitting schedule may benefit from the Executive Order (EO) 14241 titled Immediate Measures to Increase American Mineral Production issued in March 2025 to streamline permitting processes for mining projects, particularly those focused on critical minerals.

Figure 8: Development Timeline

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_008full.jpg

Future Opportunities

The Yerington Copper Project covers an extensive strategic land package, including the Bear Deposit and numerous other underexplored targets. While Lion Copper and Gold’s Project is compelling on its own, it creates the potential to act as a catalyst to consolidate with adjacent copper projects.

- Large and scalable processing facility to service and create synergies with several adjacent deposits, projects and operations.

- Utilize and expand on the existing resource base and project infrastructure to extend the life of the Project.

Figure 9. Yerington Area, Including Bear Deposit, Pumpkin Hollow Mine, and Ann Mason Deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1020/261234_fca0639ac4479bca_009full.jpg

Qualified Persons

For the purposes of Canadian National Instrument 43-101, the independent Qualified Persons responsible for preparing the scientific and technical information disclosed in this news release announcing the Study are Michael McGlynn (Samuel Engineering Inc.), Gordon Zurowski (AGP Mining Consultants) Steve Pozder (Samuel Engineering Inc.), John Rupp (Piteau Associates), Tim Maunula (T. Maunula & Associates Consulting), Herb Welhener (Independent Mining Consultants), Marie-Hélène Paré (GSI Environmental) and Adrien Butler (NewFields). The Qualified Persons named herein have reviewed and approved the information in this news release relevant to the portion of the scientific and technical information for which they are responsible.

Other disclosures of a technical or scientific nature included in this news release have been reviewed, verified, and approved by Todd Bonsall, Douglas Stiles, Steven Dischler and John Banning who are Qualified Persons as defined by Canadian National Instrument 43-101 and are employees of Lion Copper and Gold.

A Technical Report in the form required under Canadian National Instrument 43-101 will be filed within 45 days of this news release and will be available on Lion Copper and Gold’s website and on its SEDAR profile.

About Lion

Lion Copper and Gold Corp. is advancing its flagship copper project in Yerington, Nevada through an Option to Earn-in Agreement with Nuton LLC, a Rio Tinto Venture.

Further information can be found at www.lioncg.com

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

To learn more about Nuton, visit https://nuton.tech/

On behalf of the Board of Directors,

John Banning

Chief Executive Officer

Lion Copper and Gold Corp.

Pre-Feasibility Study Webinar

Please join John Banning on August 12, 2025, at 10:30 AM PDT via the Livestorm webinar link below for an overview of the Yerington Copper Project Pre-Feasibility Study results, which evaluates the Project’s technical and economic viability and its potential role in the U.S. copper supply chain amid rising domestic demand and supply limitations.

Join the webinar at the link.

Contact Information

Lion Copper and Gold Corp.

(775) 463 9600

info@lioncg.com

Non-IFRS Measures

Alternative performance measures in this news release such as “C1 cash cost”, “AISC” “free cash flow” are furnished to provide additional information. These non-GAAP performance measures are included in this news release because these statistics are used as key performance measures that management uses to monitor and assess performance of the Project, and to plan and assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a standard meaning within International Financial Reporting Standards (“IFRS”) and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Non-IFRS financial measures used in this news release and common to the copper mining industry are defined below.

Total Cash Costs and Total Cash Costs per Pound: Total Cash Costs are reflective of the cost of production. Total Cash Costs reported in the PFS include mining costs, processing & water treatment costs, general and administrative costs of the mine, offsite costs, refining costs, transportation costs and royalties. Total Cash Costs per Pound is calculated as Total Cash Costs divided by payable copper pounds.

Total Operating Costs and Total Operating Costs per Pound: Total Operating Costs are reflective of the cost of mine operations. Total Operating Costs reported in the PFS include mining costs, processing & water treatment costs, and general and administrative costs of the mine. Total Operating Cost per Pound is calculated as Total Operating Costs divided by payable copper pounds.

All-in Sustaining Costs (“AISC”) and AISC per Pound: AISC is reflective of all of the expenditures that are required to produce a pound of copper from operations. AISC reported in the PFS includes total cash costs, sustaining capital, expansion capital and closure costs, but excludes corporate general and administrative costs and salvage. AISC per Pound is calculated as AISC divided by payable copper pounds.

Forward Looking Statements

Neither Canadian Stock Exchange (CSE) nor its Regulation Services Provider (as that term is defined in the policies of the CSE Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The technical information in this news release has been reviewed and approved by John Banning, QP MMSA, CEO of Lion Copper and Gold Corp., and a qualified person as defined in NI 43-101.

Certain information in this news release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-Looking statements are often identified by terms such as “may”, “expect”, or the negative of these terms and similar expressions. Forward-Looking statements in this news release include, but are not limited to, statements with respect to the future exploration activities and anticipated results. Forward-Looking statements necessarily involve known and unknown risks, including, without limitation, risks associated with exploration activity; general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; the ability of Lion Copper and Gold to implement its business strategies; competition; currency and interest rate fluctuations and other risks.

Cautionary Note for U.S. Investors Concerning Mineral Resources and Reserves

National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Technical disclosure contained in this news release has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ from the requirements of the U.S. Securities and Exchange Commission (“SEC”) and resource information contained in this press release may not be comparable to similar information disclosed by domestic United States companies subject to the SEC’s reporting and disclosure requirements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261234

Phoenix, Arizona–(Newsfile Corp. – July 22, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison” or the “Company”) is pleased to announce that mineral processing has started with first copper sales expected in September at the fully-permitted Johnson Camp Mine (“JCM”), in southeast Arizona.

“A major milestone for Gunnison Copper has been achieved, as we started leaching copper on July 18, about one year after starting to construct the leach pad,” states Robert Winton, SVP Operations of Gunnison Copper. He continues, “Working with our partners, Nuton, M3, Rango, and Schmueser has been a pleasure and the results speak to the incredible dedication and perseverance of the entire team. We have managed to grow our 11 year no lost time accident record at JCM with over 100+ employees and contractors at site. We are just months away from producing finished copper in Arizona, when copper is trading at an all-time high price and when there is an increased need for Made in America solutions to our energy and national security.”

Progress as of the Company’s last update (see Gunnison news release dated June 9th) includes:

- Stacking and acid curing of mineralized material has commenced (Figure 1).

- Material continues to be stockpiled in advance of the completion of the leach pads (Figure 2).

- Leach pad Phase-2 is complete.

- Phase-3 leach pad is complete and conveyors constructed.

Since the Company’s last update, the Company is pleased to report that JCM construction activities continue to progress as planned. The overflow pond construction has been completed ahead of first acid irrigation. The pipelines from the leach pads to the SX/EW plant are complete, and Phase-1 pad leaching has started, with first copper cathode from Run-of-mine (ROM) oxide production using conventional leach technology scheduled for September. First copper using Nuton technology is expected before the end of the year.

Figure 1 – Stacking mineralized material from the JCM pit in panels for leaching on the ROM pad.

Figure 2 – Leach Pad Overhead View, 8 million square feet with dimensions of approximately 1220m by 640m. Phase-1 shows 4 panels of material that have started leaching and Phase 2 shows the crusher pad and Nuton process equipment area. Phase 3 in the upper right corner is the Nuton heap location with overliner being installed above the liner.

Figure 3 – Drip line delivering acidified solution to copper rich material on the ROM pad.

Figure 4 – Drip lines feeding acidified solution to leach copper from mineralized material on the ROM pad.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831,6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3 Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison’s Johnson Camp Asset, which is under construction with first copper production expected in Q3 2025, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company’s technical report entitled “Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment” dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT NUTON

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information, please visit https://nuton.tech.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4563

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) timelines for future production and production capacity from the Company’s mineral projects; (v) timelines for continued construction at JCM; (vi) the results of the preliminary economic assessment on the Gunnison Project; and (vii) the exploration and development of the Company’s mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company’s operational plans, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company’s business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259568

Phoenix, Arizona–(Newsfile Corp. – June 9, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison” or the “Company”) is pleased to announce that mineral processing will commence by July with first copper sales in September at the fully-permitted Johnson Camp Mine (“JCM”), in southeast Arizona.

Progress as of the Company’s last update (see Gunnison news release dated March 21st) included:

- Mining of mineralized material had commenced (Figure 1).

- Material was being stockpiled in advance of the completion of the leach pads (Figure 2).

- Leach pad Phase-1 was complete.

- Phase-2 leach pad was expected in the near term.

Since the Company’s last update, the Company is pleased to report that JCM construction activities are progressing as planned. The haul road to the run of mine oxide Phase-1 pad, PLS sump, culverts and overflow pond construction have started ahead of first acid irrigation. The pipelines from the leach pads to the SX/EW plant are nearing completion, and Phase-1 pad irrigation is anticipated by July, with first copper cathode from Run-of-mine (ROM) production using conventional leach technology scheduled for September. First copper using Nuton technology is expected before the end of the year.

Figure 1 – Mining mineralized material from the JCM pit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/254883_ad99f12ba4c1198e_002full.jpg

Figure 2 – Leach Pad Overhead View, 8 million square feet with dimensions of approximately 1220m by 640m. Phase 1 shows the protective, crushed rock, over-liner material on bottom half of the image and Phase 2 shows the crusher pad and Nuton process equipment area. Phase 3 in the upper right corner is the Nuton heap location with liner and overliner being installed.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/254883_ad99f12ba4c1198e_003full.jpg

“Construction activity continues its fast pace and we are getting ever closer to first irrigation of oxide mine production at JCM SX/EW restart,” states Robert Winton, SVP Operations of Gunnison Copper. He continues, “There is no better time than now to bring a new copper mine online in America, with this critical mineral playing a vital role in our energy and defense security. The efforts of our team and contractors have been second to none during the entire project.”

Figure 3 – New LNG infrastructure storage tank and vaporizers to ensure grade 1 copper production at JCM.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/254883_ad99f12ba4c1198e_004full.jpg

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a measured and indicated mineral resource containing over 831 million tons with a total copper grade of 0.31% (measured mineral resource of 191.3 million tons at 0.37% and indicated mineral resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

In addition, Gunnison’s Johnson Camp Asset, which is under construction with first copper production expected in Q3 2025, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company’s technical report entitled “Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment” dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT NUTON

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing their value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information, please visit https://nuton.tech.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Shawn Westcott

T: 604.365.6681

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) timelines for future production and production capacity from the Company’s mineral projects; (v) timelines for continued construction at JCM; (vI) the results of the preliminary economic assessment on the Gunnison Project; and (vIi) the exploration and development of the Company’s mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company’s operational plans, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company’s business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254883

Regulus Resources Inc. (“Regulus” or the “Company”, TSX-V: REG, OTCQX: RGLSF) is pleased to provide an update on the Phase Two metallurgical test program with Nuton LLC (“Nuton”), a Rio Tinto venture. As well, the Company is pleased to provide an update on the integrated resource estimate currently being completed with Compañía Minera Coimolache S.A. (“Coimolache”, collectively with Regulus, the “Parties”), to evaluate the integrated Coimolache Sulphide/AntaKori copper-gold project (“Integrated Sulphide Project”).

Nuton Phase Two Program

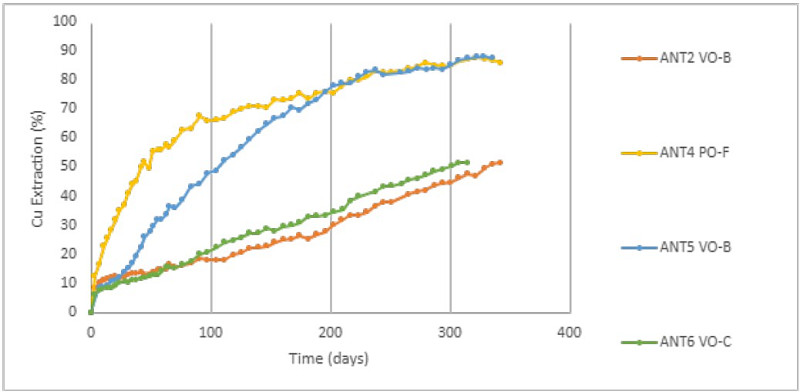

The Company continues to work with Nuton to evaluate Nuton’s proprietary sulphide bio-leaching technologies at the AntaKori project. The Phase One program identified that material from AntaKori was amenable to Nuton’s proprietary sulphide bio-leaching technology (see July 6, 2023 press release). In the Phase Two program, a variety of conditions are being evaluated, with each test column using different sets of conditions to evaluate the optimal setup for leaching AntaKori mineralization (particularly enargite-rich high-sulphidation mineralization which makes up the bulk of mineralization at the AntaKori project).

The Company is reporting on the progress of four columns today. Three of the four columns were focused on testing different conditions for enargite-rich high-sulphidation mineralization, while the other column was utilized to test chalcopyrite-dominant porphyry mineralization. The results thus far from the Phase Two program are very encouraging, as Nuton was able to achieve attractive copper extractions utilizing its Nuton bio-leaching technology on both styles of mineralization. As well, this test work has refined the understanding of which set of conditions produces attractive copper extractions for enargite-rich high-sulphidation mineralization. To date, the highest copper extraction for enargite-rich high-sulphidation mineralization is 88.3% (see Figures 1 and 2). To date, the highest copper extraction for porphyry-hosted chalcopyrite mineralization is 87.9% (see Figures 1 and 2). As mentioned previously, this phase of test work is designed to evaluate various conditions to establish the optimum additives for bio-leaching enargite-rich high-sulphidation mineralization. As such, two of the columns identified conditions that produced slower extraction rates and hence less favourable conditions than the column conditions that produced the 88.3% extraction. However, copper extractions in both of these columns continue to trend upwards. Four additional columns have since been started to further refine the optimal conditions achieved and reported here for leaching AntaKori’s enargite-rich high-sulphidation mineralization with Nuton’s bio-leaching technology. The Company will report on these additional columns when they are at or nearing completion.

Integrated Sulphide Project

Regulus and Coimolache, owner of the Tantahuatay oxide gold mine adjacent to the AntaKori project, continue to advance the Integrated Sulphide Project resource estimate. The Parties have worked collaboratively over the past several months to develop an integrated geological model effectively blending views on geology, structure and mineralization styles, which was a critical step before moving towards an integrated resource estimate. The Parties have hired SRK Peru to develop the resource estimate on the Integrated Sulphide Project and it is anticipated that the study will be completed mid-year. As per the agreement between the Parties, the results of this study can only be publicly reported or shared with third parties upon mutual agreement of the Parties.

John Black, Chief Executive Officer of Regulus, commented: “We are very encouraged by the results of the Phase Two program with Nuton. Conditions have been established under which attractive copper extraction is achieved from both high-sulphidation and porphyry mineralization utilizing Nuton’s bio-leaching technology. With several other columns underway, we continue to view Nuton’s bio-leaching technology as one of several potential processing options for mineralization at AntaKori. As well, we have made considerable progress on the integrated resource estimate with Coimolache, with the creation of an integrated geological model. SRK Peru now has all the information they need to complete the resource estimate on the Integrated Sulphide Project and we look forward to receiving the final results soon.”

Qualified Person

The scientific and technical data contained in this news release pertaining to the AntaKori project has been reviewed and approved by Dr. Kevin B. Heather, Chief Geological Officer, FAusIMM, who serves as the qualified person (QP) under the definition of National Instrument 43-101.

ON BEHALF OF THE REGULUS BOARD

(signed) “John Black”

John Black

CEO and Director

Tel: +1 (604) 685-6800

Email: info@regulusresources.com

For further information, please contact:

Regulus Resources Inc.

Ben Cherrington

Tel: +1 347 394 2728

Email: ben.cherrington@regulusresources.com

About Regulus Resources Inc. and the AntaKori Project

Regulus is an international mineral exploration company run by an experienced technical and management team. The principal project held by Regulus is the AntaKori copper-gold-silver project in northern Peru. The AntaKori project currently hosts a resource with indicated mineral resources of 250 million tonnes with a grade of 0.48 % Cu, 0.29 g/t Au and 7.5 g/t Ag and inferred mineral resources of 267 million tonnes with a grade of 0.41 % Cu, 0.26 g/t Au, and 7.8 g/t Ag (independent technical report prepared by AMEC Foster Wheeler (Peru) S.A., a Wood company, titled AntaKori Project, Cajamarca Province, Peru, NI 43-101 Technical Report, dated February 22, 2019 – see news release dated March 1, 2019). Mineralization remains open in most directions.

For further information on Regulus Resources Inc., please consult our website at www.regulusresources.com.

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing their value. With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials. One of the key differentiators of Nuton is the ambition to produce the world’s lowest footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information please visit https://nuton.tech.

Forward Looking Information

Certain statements regarding Regulus, including management’s assessment of future plans and operations, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Regulus’ control. Often, but not always, forward-looking statements or information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Specifically, and without limitation, all statements included in this press release that address activities, events or developments that Regulus expects or anticipates will or may occur in the future, including the development of the AntaKori project described herein, and management’s assessment of future plans and operations and statements with respect to the completion of the anticipated exploration and development programs, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Regulus’ control. These risks may cause actual financial and operating results, performance, levels of activity and achievements to differ materially from those expressed in, or implied by, such forward-looking statements. Although Regulus believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The forward-looking statements contained in this press release are made as of the date hereof and Aldebaran does not undertake any obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1 – Copper deportment by mineral

Figure 2 – Copper extractions (VO stands for volcanic-hosted, high-sulphidation, enargite-rich mineralization, PO stands for porphyry-hosted, chalcopyrite-rich mineralization).

“One of Nuton’s goals is to offer a processing technology that not only minimizes water requirements, but ultimately aspires to be water positive, by restoring more water than we consume through our process,” said Yusuf Jameel, PhD, Nuton’s principal sustainability advisor.

Water is one of the five pillars of Nuton’s Positive Impact ambition, and one that could be a “game-changer” for the copper industry, where mines tend to be located in water-stressed areas.

Conventional copper processing technologies require substantial amounts of water, with estimates pegging copper water intensity at around 150m3 (~40,000 gallons) of water per tonne of copper produced (from mine to metal). As Nuton is a copper leaching technology, we have an intrinsic advantage of requiring less water than a concentrator – about a third of it. Nuton as a venture wants to take that advantage to the next level through chasing efficiencies in design, reducing evaporation, reusing wastewater in our process and other opportunities.

Towards water positivity — our North Star

Minimizing the water intensity of Nuton’s process design is an important part of the journey. But the team keeps a focus on its North Star of becoming Water Positive. The team defines being Water Positive as a situation in which we “replenish more water, at least of the same quality, than the water consumed during Nuton’s process.” This is a challenging long-term goal, but the team believes it is one that could strengthen the value proposition of Nuton and the social license of the mining industry.

“One of Nuton’s goals is to offer a processing technology that not only minimizes water requirements, but ultimately aspires to be water positive, by restoring more water than we consume through our process,”

Yusuf Jameel, PhD, Nuton’s principal sustainability advisor.

Charting a water positive path — one step at a time

Every drop of water — even evaporates — matters in Nuton’s process. The current process design aims to minimize water evaporation from the heap through a thermofilm, which acts as a covering blanket and traps moist. By reducing leach pad evaporation, Nuton aims to conserve significant amounts of water, especially important in arid environments like Arizona and Nevada, where some of Nuton’s partners are located. The deployment of Nuton technologies at the Johnson Camp Mine in Arizona, currently under construction, is a prime opportunity to test these and other technical solutions to reduce water intensity and pursue Nuton’s ambition to become water positive.

Nuton’s commitment to sustainability

The Positive Impact Ambition is a core theme in Nuton’s dedication to sustainable mining, with water conservation being a crucial component of that mission. Read about our additional Impact Pillars: Energy, Land, Society and Materials.

Steve McCabe has a packed schedule. As a Senior Deployment Advisor at Nuton, a Rio Tinto venture, his job is to help bring the company’s groundbreaking heap leaching technology to life.

“It’s a lot of coordination,” Steve said, putting it simply.

From working with vendors and leading teams to building mobile labs, and analyzing materials, there’s no shortage of moving pieces ahead of Nuton’s first large-scale deployment at Johnson Camp Mine in Arizona.

Lately, Steve’s main focus has been on agglomeration, a critical step in Nuton’s process. In this phase, fine ore particles are bound together using a blend of additives and solutions, improving permeability and ensuring uniform leaching. This step is essential before the material is placed on heap leach pads, where the bio heap leaching process efficiently extracts copper.

Steve’s passion for his work is evident in his deep knowledge and expertise when discussing his daily responsibilities. He is acutely aware of his journey — from an engineer to a metallurgist to a deployment advisor —and he remains grateful for every step. As the first person in his family to attend college, he understands the significance of higher education.

“There are a lot of challenges that tribal students face,” said Steve, a member of the San Carlos Apache Tribe. For many students in his community, college may not seem likely—or even possible. The reasons are multiple and complex. Some students may not know how to take the next step after high school, while others may feel overwhelmed and unsure of what to do if college is in their plans.

“Many Tribal students underestimate themselves,” Steve explains. “They don’t see their potential. But with the right guidance, they can break through those mental barriers and start seeing what’s out there for them”.

But having a role model—someone who’s been there—can change everything. Before joining Nuton, Steve dedicated years to his Tribe’s education department, assisting students navigate the college process. He continues to mentor high schoolers today, guiding them toward opportunities they might not have realized were within reach.

Steve understands their situation well. When Steve first stepped onto Arizona State University’s campus, he intended to become a nurse. However, after exploring different degree programs, he discovered a passion for chemical engineering. That decision changed his life.

Steve’s education has had a ripple effect—not just for him, but for his entire family. Two of his three children attended Stanford University, and the other recently enrolled at Yale. He doesn’t share this to boast, but to illustrate what’s possible.

“Many Tribal students underestimate themselves,” he explains. “They don’t see their potential. But with the right guidance, they can break through those mental barriers and start seeing what’s out there for them”.

Just like Nuton is working to change the future of copper mining, Steve is working to change the future for students in his community.

Phoenix, Arizona–(Newsfile Corp. – March 3, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison”) is pleased to announce it has agreed to a non-dilutive funding transaction (the “Nuton Transaction“) with Nuton, LLC (“Nuton“), a Rio Tinto Venture, for $3 million in proceeds to Gunnison to be used toward its costs related to a Nuton testing program at the Gunnison Project, as well as the execution of the Tax Partnership Agreement with an agreed-upon allocation of the potential future proceeds from Gunnison and Nuton’s award of 48C tax credits from the U.S. government. All amounts in this news release are in United States dollars unless otherwise noted.

“The agreement announced today with Nuton provides Gunnison $3 million in non-dilutive financing and the possibility of additional funds during 2025 as result of monetizing the tax credits awarded to Gunnison and Nuton that Gunnison estimates could be up to $8 million,” states Stephen Twyerould, President & CEO of Gunnison. “Nuton’s interest in the Gunnison Copper Project’s sulfide potential and a potential extension to Stage 2 at Johnson Camp are very positive outcomes for the Company.”

Highlights

- Gunnison and Nuton have entered into a Collaboration Agreement that will provide for, among other things:

- Nuton’s exclusivity over novel heap leach processing technologies for sulfide mineralization at the Gunnison Open Pit, and

- Agreed milestones to examine the potential for an extension to the Stage 2 Work Program at the Johnson Camp Mine.

- In exchange for the above:

- Nuton will provide $3M to Gunnison to be used toward its expenses for the Nuton Stage 1 Viability study on the Gunnison Open Pit (expected in early March) and other agreed purposes; and

- The parties will work within the parameters of the Tax Partnership Agreement to allow for a portion of the realized cash proceeds from the potential sale of 48C tax credits to be distributed to Gunnison to benefit the Stage 2 project, including paying down a significant portion, or all of, the Nebari debt. Gunnison estimates that its share of the potential proceeds could be up to $8M after Nuton’s allocation and reimbursement of costs, with the actual amount depending on the 48C tax credit certification process and how much can be realized from the sale of the certified credits.

- In addition to this, Gunnison and Nebari have entered a binding term sheet (details below) that provides for the following:

- Deferral of all principal payments for the remainder of 2025, reducing carrying costs by $2.8M.

- The right to convert up to $6.25M of the principal into equity at a set conversion price based on a premium to market price or financing price.

- A trigger to initiate a process by Nebari to refinance the remaining principal maturity, if any, to December 31, 2029. The trigger occurs when the principal, currently $13.75M (including the Repayment Bonus) is reduced to $7.5M or less (the “Refinance Trigger”).

- The above provides two pathways to trigger the refinancing process, either through Nebari’s conversion of principal to equity, or through funds received under the distribution of money from the potential sale of the 48C tax credits. Should both events occur, or other funds become available, then it is possible that the entire Nebari debt could be extinguished in 2025, which is the objective of Management.

Gunnison Stage 1 Viability Testing

The parties have agreed to conduct a Stage 1 viability testing program of Nuton Technologies on sulfide mineralization at the Gunnison Open Pit (the “Stage 1 Gunnison Program“). The Stage 1 Gunnison Program will involve the collection and testing of samples from drill core from the Gunnison Project. The samples will be analyzed by Nuton for the purposes of determining the suitability of the Gunnison Project with Nuton Technologies.

Stage 2 Extension

Gunnison and Nuton have agreed to work together to evaluate the possible extension of the Stage 2 Work Program at Johnson Camp. This evaluation is guided by a set of milestones and is expected to take place over the next 4 to 6 weeks. Nuton shall also receive a right of first offer over the use of any excess capacity from the SX/EW plant and related infrastructure and mining assets located at the Johnson Camp Mine.

“This initial funding allows us to start evaluating by-product commercialization, increase sulfide production potential through drilling and testing, as well as our mineral optimization program, that are all expected to generate significant value creation. This value creation, in parallel with our Nuton partnered JCM operational ramp up and Q3 scheduled cathode production, are continuing to build Made in America copper,” commented Robert Winton SVP Operations and GM.

Intent to Negotiate Exclusive Exploration Agreement

Gunnison and Nuton (or its affiliates) have also agreed to negotiate in good faith an exclusive exploration agreement over all of Gunnison’s property for a 3-to-5-year term (or such term as agreed between the parties), on commercial terms that includes a specified work program, costs and timelines.

Sale of 48C Tax Credits

As announced on January 16, 2025, Gunnison Copper Corp and Nuton LLC have been selected to receive US$13.9 million in tax credits (the “48C tax credit“) under the Qualifying Advanced Energy Project Credit Program. Nuton and Gunnison will work within the parameters of the Tax Partnership Agreement to potentially allow for a portion of realized cash proceeds from the sale of 48C tax credits to be distributed to Gunnison to retire a significant portion, or all of, the Nebari debt, which will benefit the Stage 2 Work Program by reducing Gunnison’s debt service obligations.

The receipt of the 48C tax credit is subject to Certification as outlined in IRS Notice 2023-44. There is no certainty that the conditions to the completion of the Nuton Transaction or receipt of the 48C tax credit will be satisfied.

Amended and Restated Credit Agreement

Gunnison’s wholly-owned subsidiary Excelsior Mining Arizona, Inc. dba Gunnison Copper (“Gunnison Arizona“) have agreed with Nebari Natural Resources Credit Fund I LP (“Nebari“) to amend certain terms of the Amended and Restated Credit Agreement (the “ARCA“). The amendments provide for, amongst other matters, a suspension of principal amortization from February 1, 2025 until January 1, 2026, provide for potential partial conversion to equity, and provide for a mechanism to repay a portion of the principal amount of the ARCA with proceeds to be received from sale of the previously announced 48C tax credits and through a potential refinancing process provide for an extension of the maturity date.

ARCA Amendments

The Company, Gunnison Arizona and Nebari have signed a binding term sheet (the “Nebari Term Sheet“) setting out the terms for the following amendments to the ARCA (collectively, the “Amendments“):

- Deferral of Principal Amortization: The requirement to begin repaying the principal balance of the ARCA in monthly installments shall be suspended from February 1, 2025 until January 1, 2026. As of January 1, 2026, the remaining principal shall be amortized on a straight-line basis in equal monthly amounts or a monthly amount of $300,000, whichever is smaller.

- Equity Conversion: To provide for a potential alternative repayment mechanism, up to $6.25 million of the principal amount of the ARCA will be convertible, at Nebari’s option, into common shares of Gunnison, at a price (the “Conversion Price“) equal to the lower of (i) a 30% premium to the lowest issuance price of the common shares or units issued in any equity financing prior to March 31, 2025 (subject to minimum pricing rules of the Toronto Stock Exchange); and (ii) the lowest exercise price of any warrants issued as part of any such equity financing, provided that if no equity financing is completed prior to March 31, 2025 the Conversion Price shall be US$0.1622 (Cdn$0.2339), which is a 30% premium to the volume weighted average trading price (“VWAP“) of the common shares of Parent on the Toronto Stock Exchange for the five trading days prior to the execution of the Nebari Term Sheet.

- Principal Reduction through 48C Tax Credit: If Gunnison receives a portion of the cash received from the sale of Johnson Camp 48C tax credit it shall use the lower of $6.25 million or the full amount of the proceeds so received to pay down the non-convertible principal amount of the ARCA.