Phoenix, Arizona–(Newsfile Corp. – July 22, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison” or the “Company”) is pleased to announce that mineral processing has started with first copper sales expected in September at the fully-permitted Johnson Camp Mine (“JCM”), in southeast Arizona.

“A major milestone for Gunnison Copper has been achieved, as we started leaching copper on July 18, about one year after starting to construct the leach pad,” states Robert Winton, SVP Operations of Gunnison Copper. He continues, “Working with our partners, Nuton, M3, Rango, and Schmueser has been a pleasure and the results speak to the incredible dedication and perseverance of the entire team. We have managed to grow our 11 year no lost time accident record at JCM with over 100+ employees and contractors at site. We are just months away from producing finished copper in Arizona, when copper is trading at an all-time high price and when there is an increased need for Made in America solutions to our energy and national security.”

Progress as of the Company’s last update (see Gunnison news release dated June 9th) includes:

- Stacking and acid curing of mineralized material has commenced (Figure 1).

- Material continues to be stockpiled in advance of the completion of the leach pads (Figure 2).

- Leach pad Phase-2 is complete.

- Phase-3 leach pad is complete and conveyors constructed.

Since the Company’s last update, the Company is pleased to report that JCM construction activities continue to progress as planned. The overflow pond construction has been completed ahead of first acid irrigation. The pipelines from the leach pads to the SX/EW plant are complete, and Phase-1 pad leaching has started, with first copper cathode from Run-of-mine (ROM) oxide production using conventional leach technology scheduled for September. First copper using Nuton technology is expected before the end of the year.

Figure 1 – Stacking mineralized material from the JCM pit in panels for leaching on the ROM pad.

Figure 2 – Leach Pad Overhead View, 8 million square feet with dimensions of approximately 1220m by 640m. Phase-1 shows 4 panels of material that have started leaching and Phase 2 shows the crusher pad and Nuton process equipment area. Phase 3 in the upper right corner is the Nuton heap location with overliner being installed above the liner.

Figure 3 – Drip line delivering acidified solution to copper rich material on the ROM pad.

Figure 4 – Drip lines feeding acidified solution to leach copper from mineralized material on the ROM pad.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831,6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3 Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison’s Johnson Camp Asset, which is under construction with first copper production expected in Q3 2025, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company’s technical report entitled “Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment” dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT NUTON

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information, please visit https://nuton.tech.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4563

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) timelines for future production and production capacity from the Company’s mineral projects; (v) timelines for continued construction at JCM; (vi) the results of the preliminary economic assessment on the Gunnison Project; and (vii) the exploration and development of the Company’s mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company’s operational plans, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company’s business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259568

Phoenix, Arizona–(Newsfile Corp. – June 9, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison” or the “Company”) is pleased to announce that mineral processing will commence by July with first copper sales in September at the fully-permitted Johnson Camp Mine (“JCM”), in southeast Arizona.

Progress as of the Company’s last update (see Gunnison news release dated March 21st) included:

- Mining of mineralized material had commenced (Figure 1).

- Material was being stockpiled in advance of the completion of the leach pads (Figure 2).

- Leach pad Phase-1 was complete.

- Phase-2 leach pad was expected in the near term.

Since the Company’s last update, the Company is pleased to report that JCM construction activities are progressing as planned. The haul road to the run of mine oxide Phase-1 pad, PLS sump, culverts and overflow pond construction have started ahead of first acid irrigation. The pipelines from the leach pads to the SX/EW plant are nearing completion, and Phase-1 pad irrigation is anticipated by July, with first copper cathode from Run-of-mine (ROM) production using conventional leach technology scheduled for September. First copper using Nuton technology is expected before the end of the year.

Figure 1 – Mining mineralized material from the JCM pit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/254883_ad99f12ba4c1198e_002full.jpg

Figure 2 – Leach Pad Overhead View, 8 million square feet with dimensions of approximately 1220m by 640m. Phase 1 shows the protective, crushed rock, over-liner material on bottom half of the image and Phase 2 shows the crusher pad and Nuton process equipment area. Phase 3 in the upper right corner is the Nuton heap location with liner and overliner being installed.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/254883_ad99f12ba4c1198e_003full.jpg

“Construction activity continues its fast pace and we are getting ever closer to first irrigation of oxide mine production at JCM SX/EW restart,” states Robert Winton, SVP Operations of Gunnison Copper. He continues, “There is no better time than now to bring a new copper mine online in America, with this critical mineral playing a vital role in our energy and defense security. The efforts of our team and contractors have been second to none during the entire project.”

Figure 3 – New LNG infrastructure storage tank and vaporizers to ensure grade 1 copper production at JCM.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2744/254883_ad99f12ba4c1198e_004full.jpg

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a measured and indicated mineral resource containing over 831 million tons with a total copper grade of 0.31% (measured mineral resource of 191.3 million tons at 0.37% and indicated mineral resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

In addition, Gunnison’s Johnson Camp Asset, which is under construction with first copper production expected in Q3 2025, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company’s technical report entitled “Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment” dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT NUTON

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing their value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information, please visit https://nuton.tech.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Shawn Westcott

T: 604.365.6681

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) timelines for future production and production capacity from the Company’s mineral projects; (v) timelines for continued construction at JCM; (vI) the results of the preliminary economic assessment on the Gunnison Project; and (vIi) the exploration and development of the Company’s mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company’s operational plans, the estimation of mineral resources, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company’s business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254883

Regulus Resources Inc. (“Regulus” or the “Company”, TSX-V: REG, OTCQX: RGLSF) is pleased to provide an update on the Phase Two metallurgical test program with Nuton LLC (“Nuton”), a Rio Tinto venture. As well, the Company is pleased to provide an update on the integrated resource estimate currently being completed with Compañía Minera Coimolache S.A. (“Coimolache”, collectively with Regulus, the “Parties”), to evaluate the integrated Coimolache Sulphide/AntaKori copper-gold project (“Integrated Sulphide Project”).

Nuton Phase Two Program

The Company continues to work with Nuton to evaluate Nuton’s proprietary sulphide bio-leaching technologies at the AntaKori project. The Phase One program identified that material from AntaKori was amenable to Nuton’s proprietary sulphide bio-leaching technology (see July 6, 2023 press release). In the Phase Two program, a variety of conditions are being evaluated, with each test column using different sets of conditions to evaluate the optimal setup for leaching AntaKori mineralization (particularly enargite-rich high-sulphidation mineralization which makes up the bulk of mineralization at the AntaKori project).

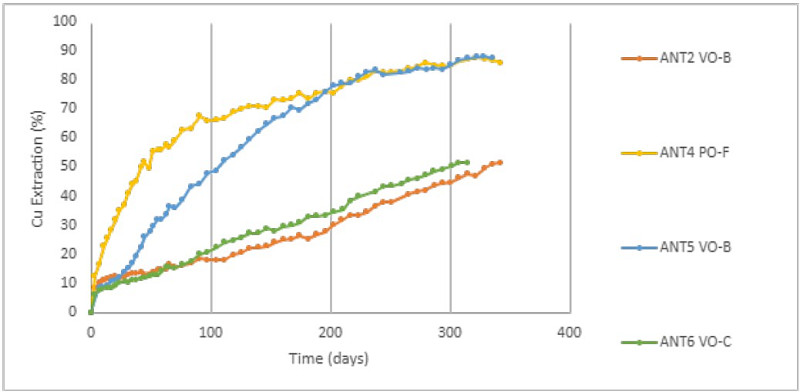

The Company is reporting on the progress of four columns today. Three of the four columns were focused on testing different conditions for enargite-rich high-sulphidation mineralization, while the other column was utilized to test chalcopyrite-dominant porphyry mineralization. The results thus far from the Phase Two program are very encouraging, as Nuton was able to achieve attractive copper extractions utilizing its Nuton bio-leaching technology on both styles of mineralization. As well, this test work has refined the understanding of which set of conditions produces attractive copper extractions for enargite-rich high-sulphidation mineralization. To date, the highest copper extraction for enargite-rich high-sulphidation mineralization is 88.3% (see Figures 1 and 2). To date, the highest copper extraction for porphyry-hosted chalcopyrite mineralization is 87.9% (see Figures 1 and 2). As mentioned previously, this phase of test work is designed to evaluate various conditions to establish the optimum additives for bio-leaching enargite-rich high-sulphidation mineralization. As such, two of the columns identified conditions that produced slower extraction rates and hence less favourable conditions than the column conditions that produced the 88.3% extraction. However, copper extractions in both of these columns continue to trend upwards. Four additional columns have since been started to further refine the optimal conditions achieved and reported here for leaching AntaKori’s enargite-rich high-sulphidation mineralization with Nuton’s bio-leaching technology. The Company will report on these additional columns when they are at or nearing completion.

Integrated Sulphide Project

Regulus and Coimolache, owner of the Tantahuatay oxide gold mine adjacent to the AntaKori project, continue to advance the Integrated Sulphide Project resource estimate. The Parties have worked collaboratively over the past several months to develop an integrated geological model effectively blending views on geology, structure and mineralization styles, which was a critical step before moving towards an integrated resource estimate. The Parties have hired SRK Peru to develop the resource estimate on the Integrated Sulphide Project and it is anticipated that the study will be completed mid-year. As per the agreement between the Parties, the results of this study can only be publicly reported or shared with third parties upon mutual agreement of the Parties.

John Black, Chief Executive Officer of Regulus, commented: “We are very encouraged by the results of the Phase Two program with Nuton. Conditions have been established under which attractive copper extraction is achieved from both high-sulphidation and porphyry mineralization utilizing Nuton’s bio-leaching technology. With several other columns underway, we continue to view Nuton’s bio-leaching technology as one of several potential processing options for mineralization at AntaKori. As well, we have made considerable progress on the integrated resource estimate with Coimolache, with the creation of an integrated geological model. SRK Peru now has all the information they need to complete the resource estimate on the Integrated Sulphide Project and we look forward to receiving the final results soon.”

Qualified Person

The scientific and technical data contained in this news release pertaining to the AntaKori project has been reviewed and approved by Dr. Kevin B. Heather, Chief Geological Officer, FAusIMM, who serves as the qualified person (QP) under the definition of National Instrument 43-101.

ON BEHALF OF THE REGULUS BOARD

(signed) “John Black”

John Black

CEO and Director

Tel: +1 (604) 685-6800

Email: info@regulusresources.com

For further information, please contact:

Regulus Resources Inc.

Ben Cherrington

Tel: +1 347 394 2728

Email: ben.cherrington@regulusresources.com

About Regulus Resources Inc. and the AntaKori Project

Regulus is an international mineral exploration company run by an experienced technical and management team. The principal project held by Regulus is the AntaKori copper-gold-silver project in northern Peru. The AntaKori project currently hosts a resource with indicated mineral resources of 250 million tonnes with a grade of 0.48 % Cu, 0.29 g/t Au and 7.5 g/t Ag and inferred mineral resources of 267 million tonnes with a grade of 0.41 % Cu, 0.26 g/t Au, and 7.8 g/t Ag (independent technical report prepared by AMEC Foster Wheeler (Peru) S.A., a Wood company, titled AntaKori Project, Cajamarca Province, Peru, NI 43-101 Technical Report, dated February 22, 2019 – see news release dated March 1, 2019). Mineralization remains open in most directions.

For further information on Regulus Resources Inc., please consult our website at www.regulusresources.com.

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing their value. With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials. One of the key differentiators of Nuton is the ambition to produce the world’s lowest footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information please visit https://nuton.tech.

Forward Looking Information

Certain statements regarding Regulus, including management’s assessment of future plans and operations, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Regulus’ control. Often, but not always, forward-looking statements or information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Specifically, and without limitation, all statements included in this press release that address activities, events or developments that Regulus expects or anticipates will or may occur in the future, including the development of the AntaKori project described herein, and management’s assessment of future plans and operations and statements with respect to the completion of the anticipated exploration and development programs, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Regulus’ control. These risks may cause actual financial and operating results, performance, levels of activity and achievements to differ materially from those expressed in, or implied by, such forward-looking statements. Although Regulus believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The forward-looking statements contained in this press release are made as of the date hereof and Aldebaran does not undertake any obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1 – Copper deportment by mineral

Figure 2 – Copper extractions (VO stands for volcanic-hosted, high-sulphidation, enargite-rich mineralization, PO stands for porphyry-hosted, chalcopyrite-rich mineralization).

“One of Nuton’s goals is to offer a processing technology that not only minimizes water requirements, but ultimately aspires to be water positive, by restoring more water than we consume through our process,” said Yusuf Jameel, PhD, Nuton’s principal sustainability advisor.

Water is one of the five pillars of Nuton’s Positive Impact ambition, and one that could be a “game-changer” for the copper industry, where mines tend to be located in water-stressed areas.

Conventional copper processing technologies require substantial amounts of water, with estimates pegging copper water intensity at around 150m3 (~40,000 gallons) of water per tonne of copper produced (from mine to metal). As Nuton is a copper leaching technology, we have an intrinsic advantage of requiring less water than a concentrator – about a third of it. Nuton as a venture wants to take that advantage to the next level through chasing efficiencies in design, reducing evaporation, reusing wastewater in our process and other opportunities.

Towards water positivity — our North Star

Minimizing the water intensity of Nuton’s process design is an important part of the journey. But the team keeps a focus on its North Star of becoming Water Positive. The team defines being Water Positive as a situation in which we “replenish more water, at least of the same quality, than the water consumed during Nuton’s process.” This is a challenging long-term goal, but the team believes it is one that could strengthen the value proposition of Nuton and the social license of the mining industry.

“One of Nuton’s goals is to offer a processing technology that not only minimizes water requirements, but ultimately aspires to be water positive, by restoring more water than we consume through our process,”

Yusuf Jameel, PhD, Nuton’s principal sustainability advisor.

Charting a water positive path — one step at a time

Every drop of water — even evaporates — matters in Nuton’s process. The current process design aims to minimize water evaporation from the heap through a thermofilm, which acts as a covering blanket and traps moist. By reducing leach pad evaporation, Nuton aims to conserve significant amounts of water, especially important in arid environments like Arizona and Nevada, where some of Nuton’s partners are located. The deployment of Nuton technologies at the Johnson Camp Mine in Arizona, currently under construction, is a prime opportunity to test these and other technical solutions to reduce water intensity and pursue Nuton’s ambition to become water positive.

Nuton’s commitment to sustainability

The Positive Impact Ambition is a core theme in Nuton’s dedication to sustainable mining, with water conservation being a crucial component of that mission. Read about our additional Impact Pillars: Energy, Land, Society and Materials.

Steve McCabe has a packed schedule. As a Senior Deployment Advisor at Nuton, a Rio Tinto venture, his job is to help bring the company’s groundbreaking heap leaching technology to life.

“It’s a lot of coordination,” Steve said, putting it simply.

From working with vendors and leading teams to building mobile labs, and analyzing materials, there’s no shortage of moving pieces ahead of Nuton’s first large-scale deployment at Johnson Camp Mine in Arizona.

Lately, Steve’s main focus has been on agglomeration, a critical step in Nuton’s process. In this phase, fine ore particles are bound together using a blend of additives and solutions, improving permeability and ensuring uniform leaching. This step is essential before the material is placed on heap leach pads, where the bio heap leaching process efficiently extracts copper.

Steve’s passion for his work is evident in his deep knowledge and expertise when discussing his daily responsibilities. He is acutely aware of his journey — from an engineer to a metallurgist to a deployment advisor —and he remains grateful for every step. As the first person in his family to attend college, he understands the significance of higher education.

“There are a lot of challenges that tribal students face,” said Steve, a member of the San Carlos Apache Tribe. For many students in his community, college may not seem likely—or even possible. The reasons are multiple and complex. Some students may not know how to take the next step after high school, while others may feel overwhelmed and unsure of what to do if college is in their plans.

“Many Tribal students underestimate themselves,” Steve explains. “They don’t see their potential. But with the right guidance, they can break through those mental barriers and start seeing what’s out there for them”.

But having a role model—someone who’s been there—can change everything. Before joining Nuton, Steve dedicated years to his Tribe’s education department, assisting students navigate the college process. He continues to mentor high schoolers today, guiding them toward opportunities they might not have realized were within reach.

Steve understands their situation well. When Steve first stepped onto Arizona State University’s campus, he intended to become a nurse. However, after exploring different degree programs, he discovered a passion for chemical engineering. That decision changed his life.

Steve’s education has had a ripple effect—not just for him, but for his entire family. Two of his three children attended Stanford University, and the other recently enrolled at Yale. He doesn’t share this to boast, but to illustrate what’s possible.

“Many Tribal students underestimate themselves,” he explains. “They don’t see their potential. But with the right guidance, they can break through those mental barriers and start seeing what’s out there for them”.

Just like Nuton is working to change the future of copper mining, Steve is working to change the future for students in his community.

Phoenix, Arizona–(Newsfile Corp. – March 3, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison”) is pleased to announce it has agreed to a non-dilutive funding transaction (the “Nuton Transaction“) with Nuton, LLC (“Nuton“), a Rio Tinto Venture, for $3 million in proceeds to Gunnison to be used toward its costs related to a Nuton testing program at the Gunnison Project, as well as the execution of the Tax Partnership Agreement with an agreed-upon allocation of the potential future proceeds from Gunnison and Nuton’s award of 48C tax credits from the U.S. government. All amounts in this news release are in United States dollars unless otherwise noted.

“The agreement announced today with Nuton provides Gunnison $3 million in non-dilutive financing and the possibility of additional funds during 2025 as result of monetizing the tax credits awarded to Gunnison and Nuton that Gunnison estimates could be up to $8 million,” states Stephen Twyerould, President & CEO of Gunnison. “Nuton’s interest in the Gunnison Copper Project’s sulfide potential and a potential extension to Stage 2 at Johnson Camp are very positive outcomes for the Company.”

Highlights

- Gunnison and Nuton have entered into a Collaboration Agreement that will provide for, among other things:

- Nuton’s exclusivity over novel heap leach processing technologies for sulfide mineralization at the Gunnison Open Pit, and

- Agreed milestones to examine the potential for an extension to the Stage 2 Work Program at the Johnson Camp Mine.

- In exchange for the above:

- Nuton will provide $3M to Gunnison to be used toward its expenses for the Nuton Stage 1 Viability study on the Gunnison Open Pit (expected in early March) and other agreed purposes; and

- The parties will work within the parameters of the Tax Partnership Agreement to allow for a portion of the realized cash proceeds from the potential sale of 48C tax credits to be distributed to Gunnison to benefit the Stage 2 project, including paying down a significant portion, or all of, the Nebari debt. Gunnison estimates that its share of the potential proceeds could be up to $8M after Nuton’s allocation and reimbursement of costs, with the actual amount depending on the 48C tax credit certification process and how much can be realized from the sale of the certified credits.

- In addition to this, Gunnison and Nebari have entered a binding term sheet (details below) that provides for the following:

- Deferral of all principal payments for the remainder of 2025, reducing carrying costs by $2.8M.

- The right to convert up to $6.25M of the principal into equity at a set conversion price based on a premium to market price or financing price.

- A trigger to initiate a process by Nebari to refinance the remaining principal maturity, if any, to December 31, 2029. The trigger occurs when the principal, currently $13.75M (including the Repayment Bonus) is reduced to $7.5M or less (the “Refinance Trigger”).

- The above provides two pathways to trigger the refinancing process, either through Nebari’s conversion of principal to equity, or through funds received under the distribution of money from the potential sale of the 48C tax credits. Should both events occur, or other funds become available, then it is possible that the entire Nebari debt could be extinguished in 2025, which is the objective of Management.

Gunnison Stage 1 Viability Testing

The parties have agreed to conduct a Stage 1 viability testing program of Nuton Technologies on sulfide mineralization at the Gunnison Open Pit (the “Stage 1 Gunnison Program“). The Stage 1 Gunnison Program will involve the collection and testing of samples from drill core from the Gunnison Project. The samples will be analyzed by Nuton for the purposes of determining the suitability of the Gunnison Project with Nuton Technologies.

Stage 2 Extension

Gunnison and Nuton have agreed to work together to evaluate the possible extension of the Stage 2 Work Program at Johnson Camp. This evaluation is guided by a set of milestones and is expected to take place over the next 4 to 6 weeks. Nuton shall also receive a right of first offer over the use of any excess capacity from the SX/EW plant and related infrastructure and mining assets located at the Johnson Camp Mine.

“This initial funding allows us to start evaluating by-product commercialization, increase sulfide production potential through drilling and testing, as well as our mineral optimization program, that are all expected to generate significant value creation. This value creation, in parallel with our Nuton partnered JCM operational ramp up and Q3 scheduled cathode production, are continuing to build Made in America copper,” commented Robert Winton SVP Operations and GM.

Intent to Negotiate Exclusive Exploration Agreement

Gunnison and Nuton (or its affiliates) have also agreed to negotiate in good faith an exclusive exploration agreement over all of Gunnison’s property for a 3-to-5-year term (or such term as agreed between the parties), on commercial terms that includes a specified work program, costs and timelines.

Sale of 48C Tax Credits

As announced on January 16, 2025, Gunnison Copper Corp and Nuton LLC have been selected to receive US$13.9 million in tax credits (the “48C tax credit“) under the Qualifying Advanced Energy Project Credit Program. Nuton and Gunnison will work within the parameters of the Tax Partnership Agreement to potentially allow for a portion of realized cash proceeds from the sale of 48C tax credits to be distributed to Gunnison to retire a significant portion, or all of, the Nebari debt, which will benefit the Stage 2 Work Program by reducing Gunnison’s debt service obligations.

The receipt of the 48C tax credit is subject to Certification as outlined in IRS Notice 2023-44. There is no certainty that the conditions to the completion of the Nuton Transaction or receipt of the 48C tax credit will be satisfied.

Amended and Restated Credit Agreement

Gunnison’s wholly-owned subsidiary Excelsior Mining Arizona, Inc. dba Gunnison Copper (“Gunnison Arizona“) have agreed with Nebari Natural Resources Credit Fund I LP (“Nebari“) to amend certain terms of the Amended and Restated Credit Agreement (the “ARCA“). The amendments provide for, amongst other matters, a suspension of principal amortization from February 1, 2025 until January 1, 2026, provide for potential partial conversion to equity, and provide for a mechanism to repay a portion of the principal amount of the ARCA with proceeds to be received from sale of the previously announced 48C tax credits and through a potential refinancing process provide for an extension of the maturity date.

ARCA Amendments

The Company, Gunnison Arizona and Nebari have signed a binding term sheet (the “Nebari Term Sheet“) setting out the terms for the following amendments to the ARCA (collectively, the “Amendments“):

- Deferral of Principal Amortization: The requirement to begin repaying the principal balance of the ARCA in monthly installments shall be suspended from February 1, 2025 until January 1, 2026. As of January 1, 2026, the remaining principal shall be amortized on a straight-line basis in equal monthly amounts or a monthly amount of $300,000, whichever is smaller.

- Equity Conversion: To provide for a potential alternative repayment mechanism, up to $6.25 million of the principal amount of the ARCA will be convertible, at Nebari’s option, into common shares of Gunnison, at a price (the “Conversion Price“) equal to the lower of (i) a 30% premium to the lowest issuance price of the common shares or units issued in any equity financing prior to March 31, 2025 (subject to minimum pricing rules of the Toronto Stock Exchange); and (ii) the lowest exercise price of any warrants issued as part of any such equity financing, provided that if no equity financing is completed prior to March 31, 2025 the Conversion Price shall be US$0.1622 (Cdn$0.2339), which is a 30% premium to the volume weighted average trading price (“VWAP“) of the common shares of Parent on the Toronto Stock Exchange for the five trading days prior to the execution of the Nebari Term Sheet.

- Principal Reduction through 48C Tax Credit: If Gunnison receives a portion of the cash received from the sale of Johnson Camp 48C tax credit it shall use the lower of $6.25 million or the full amount of the proceeds so received to pay down the non-convertible principal amount of the ARCA.

- Maturity Date Extension: In the event that the principal amount of the ARCA is reduced to $7.5 million or less (whether through conversion or repayment in cash (including cash from the 48C tax credit)), Nebari agrees to seek sale and assignment of the ARCA to another party (the “Loan Buyer“). The assigned ARCA shall have its maturity date amended to 31 December 2029, or such earlier date as agreed between the Loan Buyer and Gunnison, and no amortization shall be due on the convertible portion of the ARCA until the amended maturity date.

- Minimum Cash Balance: The existing financial covenants related to a minimum cash balance and accounts payable aging shall be adjusted so that they only apply to cash and accounts payable that are not related to the Stage 2 Work Program with Nuton, LLC. Furthermore, the required minimum cash balance shall be $1 million.

- Security: Gunnison’s subsidiary Excelsior Mining Holdings, Inc. shall become part of Nebari’s collateral package.

The Amendments are subject to certain conditions including approval of the Toronto Stock Exchange, approval from Greenstone Resources L.P. (“Greenstone“) and Triple Flag, deferral of interest payments due under convertible debentures due to Greenstone and Triple Flag, certain agreements between Nebari and Triple Flag agreement and commencement of a work program by Gunnison to optimize certain opportunities identified in the preliminary economic assessment for the Gunnison Project.

Nebari is at arm’s length to the Company. There are no commissions or finders’ fees payable in connection with the transactions discussed in this news release. While the Nebari Term Sheet is binding, the parties intend to conclude a second amended and restated credit agreement reflecting the terms in the Nebari Term Sheet. There is no assurance that the conditions to the Amendments will be satisfied.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a measured and indicated mineral resource containing over 831 million tons with a total copper grade of 0.31% (measured mineral resource of 191.3 million tons at 0.37% and indicated mineral resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

In addition, Gunnison’s Johnson Camp Asset, which is under construction with first copper production expected in mid 2025, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company’s technical report entitled “Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment” dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Mr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT NUTON

Nuton, a subsidiary of Rio Tinto, is an innovative venture focused on finding better ways to produce the copper the world needs with the smallest possible environmental footprint. At the core of Nuton is a portfolio of proprietary nature-based leaching technologies and capabilities that offer the potential to economically unlock copper through bio-heap leaching, including from primary sulfide resources, achieving market-leading recovery rates and increasing copper production at new and ongoing operations. One of the key differentiators of Nuton is our ambition to produce the world’s lowest carbon footprint copper while having at least one Positive Impact at each deployment site across five pillars: water, energy, land, materials and society.

To learn more about Nuton, visit https://nuton.tech/

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Shawn Westcott

T: 604.365.6681

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” concerning anticipated developments and events that may occur in the future. Forward looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) future production and production capacity from the Company’s mineral projects; (v) the results of the preliminary economic assessment on the Gunnison Project; (vi) the exploration and development of the Company’s mineral projects; (vii) the satisfaction of final conditions and receipt of 48C tax credits; (viii) the terms of the Nuton Transaction; (ix) the terms of the Amendments; and (xi) the satisfaction of the conditions to the Nuton Transaction and the Amendments.

In certain cases, forward-looking information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, Nuton and Gunnison will execute definitive agreements for the Nuton Transaction, Gunnison and Nebari will execute definitive agreements for the Amendments, the availability of financing to continue as a going concern and implement the Company’s operational plans, the allocation of the 48C tax credits between the Company and Nuton, the satisfaction of the requirements set forth in Section 48C of the Internal Revenue Code, the estimation of mineral resources, the realization of resource and reserve estimates, , copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton and Gunnison failing to conclude definitive agreements for the Nuton Transaction, Nebari and Gunnison failing to conclude definitive agreements for the Amendments, Nuton failing to continue to fund the stage 2 work program, the failure to satisfy the requirements set forth in Section 48C of the Internal Revenue Code, 100% of the 48C tax credits may be allocated to repay capital expenditures for the Johnson Camp mine, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company’s business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/243016

Jeana Ratcliff, who works as a Senior Sustainability Advisor at Nuton, a Rio Tinto venture, was born to be a scientist. Growing up in Montana, she spent her childhood outdoors with her science-minded parents, rock-hounding and learning about geology.

Her curiosity extended indoors, where – she constantly tinkered with electronics, learning the ins and outs of any machine she could get her hands on. Jeana fondly recalls buying an old keyboard, taking it apart, and attempting to reassemble it with her two sisters. Her inquisitive nature and love for learning have persisted into her current role at Nuton.

In celebration of International Day of Women and Girls in Science, Jeana shared insights about her career journey in the sciences, lessons learned along the way, and the advice she would offer others, especially women, considering a career in science.

What does a typical day at Nuton look like for you?

That’s a big question (laughs). Nuton is very dynamic, we’re growing and changing everyday. My focus on sustainability is really Nuton’s overall mission; to produce copper with a positive impact. I’m lucky to be involved in bringing that vision to life.

Most of my work is to directly engage and interface with our partners. I assess where their operations currently are, and how we can explore further opportunities to improve performance through Nuton. We like to challenge the status quo by asking ‘How do we move forward in creating a more sustainable kind of copper supply chain?’

Day to day, my work is quite varied. It’s a good mix of relationship building and data management, and I get to spend some time out in the field every now and then. I enjoy getting out there and being able to see operations, boots on the ground.

Do you like your job?

Yes! Mining is very interesting. You touch every science discipline in this industry. Especially the environmental sciences but also there’s water, biology, chemistry, electrical, mechanical; there’s sort of a piece of every kind of science. I learn a lot every day, which is fun.

How did you first become interested in this particular field?

Most of my family is in the mining industry. My dad is a geophysicist, my mom is a geological engineer. It’s funny, when I first got to college I wanted to explore other careers, but I ended up with a degree in civil engineering and land rehabilitation and found my way back to mining. It’s just fun and super dynamic! Much of my interest had to do with the exposure that I had growing up with my family and the things that we did together. This work is fun, I like it, and I feel like I’m good at it.

What kind of science or mining activities did you and your family do when you were young?

We loved going out to do small-scale prospecting or rock-hounding even. For much of my childhood, my mom was working on mine sites, so having that female role model was huge. What she was doing while being a mother to our family was just a normal thing for me. It didn’t feel like there was a barrier to being a woman doing science-related work. I was like, ‘Oh, Mom’s doing it, so off we go.’

What does it mean to young women to have a role model to look up to in your industry?

I think it’s huge. The classic saying is, if you see it, you can be it. I think that that’s true for a lot of people. Sometimes in the mining industry, there’s still this perception of who does that kind of work. To work in the mining industry does not mean that you’re the guy in the tunnel with the pick axe. Those jobs do exist in some places, but there’s so much more out there.

Having women in leadership positions and different roles can help others understand that there are many different paths to being successful in mining.

What’s your message to young females considering a science-related profession, perhaps in mining specifically?

I think my biggest message is that you don’t have to know everything, and you don’t have to be perfect. A lot of engineers, and scientists, particularly women, struggle with this.

Even as you get further into your career, you should still be learning. There’s a lot of imposter syndrome or fear of asking questions, but I recommend just being curious and allowing yourself to learn more and come up with new ideas. It can feel vulnerable. But realize you don’t have to be 100% perfect at everything to have success.