Vancouver, British Columbia – January 22, 2026 — Lion Copper and Gold Corp. (“Lion CG” or the “Company”) is pleased to announce that it has received US$30.5 million from Nuton LLC (“Nuton”), a wholly-owned subsidiary of Rio Tinto, further to the Company’s press release dated November 24, 2025, pursuant to the parties’ previously announced earn-in agreement relating to the advancement of the Yerington Copper Project in Nevada, USA.

The funding represents Nuton’s investment under Stage 3 of the earn-in framework and will be used to advance the Definitive Feasibility Study (DFS) and associated permitting activities, including technical optimization, engineering, environmental studies, and regulatory engagement.

“This investment represents a major execution milestone for Lion CG and further validates the scale, quality and strategic importance of the Yerington Copper Project,” said John Banning, Chief Executive Officer of Lion CG. “This substantial partner funding enables the Company to advance the DFS and permitting work without significant dilution and execution risk for Lion CG shareholders.”

The Yerington Copper Project is located in a Tier-1 U.S. jurisdiction and has the potential, subject to the outcomes of ongoing studies and permitting, to contribute to the domestic production of copper cathode. Establishing additional U.S.-based copper cathode supply is increasingly viewed as strategically important given rising demand from electrification, grid modernization, electric vehicles, and data center infrastructure, and ongoing efforts to strengthen domestic critical mineral supply chains.

Lion CG intends to progress the Yerington Copper Project toward qualification under the U.S. federal FAST-41 permitting framework, which is designed to enhance transparency, coordination, and predictability in the federal permitting process for major infrastructure and critical mineral projects.

As part of the DFS work program, the Nuton® Technology is expected to be further refined, with the objective of improving copper recoveries and potentially reducing capital intensity and environmental footprint relative to conventional processing routes.

Lion CG remains focused on disciplined project advancement, capital stewardship, and long-term value creation as it advances Yerington toward potential development in support of secure, domestic copper supply.

About Lion CG

Lion CG is a junior mining company advancing its Yerington, MacArthur and Bear projects in Lyon County, Nevada through an earn-in agreement with Nuton. The Project focuses on accelerating production from its long-life, low-strip-ratio, brownfield-advantaged Yerington Copper Project utilizing modern processing technologies.

About Nuton

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching related technologies and capability that offers the potential to economically unlock copper from primary sulfide resources through leaching, achieving market-leading recovery rates and contributing to an increase in copper production at new and ongoing operations.

One of the key differentiators of Nuton is the ambition to produce the world’s lowest footprint copper while having at least one Positive Impact at each deployment site across five pillars: water, energy, land, materials and society.

To learn more about Nuton, visit https://nuton.tech/

John Banning

Chief Executive Officer

Lion Copper and Gold Corp.

For more information, please contact:

Email: info@lioncg.com

Forward-Looking Statements

Neither Canadian Stock Exchange (CSE) nor its Regulation Services Provider (as that term is defined in the policies of the CSE Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws (collectively, “forward-looking statements”). Forward-looking statements relate to future events or performance and reflect the Company’s current expectations or beliefs regarding future events. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements in this release include, but are not limited to, completion of a Definitive Feasibility Study, permitting, engineering and technical work programs; the potential timing and pathway to commercial copper cathode production; the potential deployment of Nuton® Technology at the Yerington Copper Project; the possible creation of an investment vehicle and the respective ownership interests upon completion of Stage 3; the Company’s expectations regarding project derisking, strategic milestones, and ongoing collaboration with Nuton; and the Yerington Project’s ability to contribute to domestic copper supply and respond to increasing market demand. Forward-looking statements are based on a number of assumptions that, while considered reasonable by the Company at the date of this news release, are inherently subject to significant operational, technical, economic, and competitive uncertainties and contingencies. These assumptions include, but are not limited to: that the Feasibility Study and permitting process will be completed on the anticipated schedule; that Nuton™ Technology will operate as intended at scale; that required regulatory approvals will be obtained; that financing will be available on reasonable terms; and that market conditions for copper will remain favourable. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements. These risks include, but are not limited to: risks related to mineral exploration and development, permitting delays, changes in regulatory frameworks, cost escalation, inability to secure financing, technical challenges associated with deployment of new extraction technologies, commodity price fluctuations, community relations, supply chain constraints, and other customary risks in the mining and technology sectors. There can be no assurance that Stage 3 will be completed as contemplated, or at all, that the Parties will proceed to establish an investment Vehicle upon completion of Stage 3, that the Yerington Project will reach commercial production, or that Nuton® Technology will provide intended benefits at scale. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake any obligation to update or revise any forward-looking statements except as required by applicable securities laws. Forward-looking statements speak only as of the date of this news release

Mine reclamation is an arduous process, often taking decades to complete. All modern copper mines in the US operate under strict reclamation requirements, varied by location and jurisdiction. Reclamation is often a continuous process that occurs throughout the life of a mine, not just at its closure. The primary objectives are to promote biodiversity conservation, provide social and economic benefits to local communities, and restore the mined areas to a state of environmental sustainability.

The future of mining depends on sustainable operations to ease mine reclamation and improve environmental impact. A recent study concludes that more copper will be mined over the next 32 years than all of previous history. As the global copper industry sits at near-exponential growth, mines must minimize long-term impact on the environment by utilizing sustainable mining operations, such as Nuton’s nature-based bioleach technologies.

Introduction to mine reclamation

What happens to a mine once it closes? Is it left as a barren, abandoned site, or can it be restored to a healthy ecosystem? The answer lies in mine reclamation – a process that breathes new life into former mining sites, restoring them to stable, productive landscapes.

Mining has played a crucial role in economic development for centuries, supplying essential materials for various industries worldwide. However, the environmental impact of mining – such as land excavation and water use – cannot be overlooked. Mine reclamation offers a practical and necessary solution, helping to reduce or even reverse these impacts.

Mine reclamation, also known as land rehabilitation, is the process of restoring a former mine site to an environmentally-sound state. It’s not just about improving the landscape; it goes as far as rehabilitating ecosystems and ensuring long-term environmental stability. By implementing responsible reclamation, the mining industry moves toward a future of minimal impact operations.

By implementing responsible reclamation, the mining industry moves toward a future of minimal impact operations.

How mine reclamation works

Mine reclamation begins long before mining operations begin. Companies, including Rio Tinto and Nuton, develop detailed plans to ensure land rehabilitation includes reshaping the land, treating water bodies to remove contaminants, restoring topsoil, and reintroducing native vegetation.

Modern reclamation goes even further. Efforts include creating wetlands, restoring streams, and repurposing land for community use, such as parks or agriculture. These initiatives not only heal the environment but also provide lasting social and economic benefits.

Regulations and laws: SMCRA

In the United States, mine reclamation is governed by strict regulations. The most significant of these is the Surface Mining Control and Reclamation Act of 1977 (SMCRA), which sets standards for post-mining land restoration. SMCRA requires mining companies to plan for reclamation before operations begin and secure financial bonds to ensure that restoration is completed.

This law has been instrumental in mitigating the environmental impact of mining, particularly in coal operations. Additionally, state-level regulations complement federal laws, ensuring that reclamation efforts are tailored to each site’s specific needs and environmental conditions.

Mine reclamation challenges and innovations

While mine reclamation is essential, it comes with challenges. Restoring native ecosystems is complex, requiring careful planning and long-term monitoring. Issues such as soil erosion, land instability, and habitat loss demand innovative solutions.

Fortunately, advancements in technology make reclamation more effective. Cutting-edge soil stabilization techniques and bioengineering innovations address these challenges head-on. Through ongoing research, industry collaboration, and sustainable mining practices, mine reclamation is becoming more efficient and impactful.

Sustainable mining to support mine reclamation

The future of sustainable mining depends on responsible land rehabilitation.

Nuton mining partners benefit from nature-based bioleach technologies to mitigate environmental impact and ease mine reclamation, Nuton’s sustainable mining technology helps process waste materials, accelerate copper leaching, reduce environmental footprint, and eliminate use of concentrators, refineries and smelters.

Rio Tinto today announces a strategic collaboration with Amazon Web Services (AWS) that will see AWS become Nuton® Technology’s first customer following the breakthrough industrial-scale deployment of the innovative bioleaching technology at the Johnson Camp copper mine in the U.S. last month.

Under the two-year agreement, AWS will use the first Nuton copper ever produced in components of its U.S. data centres, while also providing cloud-based data and analytics support to accelerate the optimisation of Nuton’s proprietary bioleaching technology at Gunnison Copper’s Johnson Camp mine. Data centres use copper in a wide variety of applications, including electrical cables and busbars, windings in transformers and motors, printed circuit boards, and heat sinks on processors.

Nuton is also utilising AWS platforms to simulate heap-leach performance and feed advanced analytics into Nuton’s decision systems, allowing for optimised acid and water use while improving predictions for copper recovery. It’s modular bioleaching system works by extracting copper from primary sulphide ores using naturally occurring microorganisms. This approach, combined with digital tools, enables rapid scaling and tailoring of the technology to different ore bodies, reducing the pathway from concept to production.

The process produces 99.99% pure copper cathode at the mine gate and removes the need for traditional concentrators, smelters and refineries, significantly shortening the mine-to-market supply chain. Nuton is projected to use substantially less water and have lower carbon emissions compared with conventional concentrator processing routes, while also recovering value from ore previously classified as waste.

Rio Tinto Copper Chief Executive Katie Jackson said:“This collaboration is a powerful example of how industrial innovation and cloud technology can combine to deliver cleaner, lower-carbon materials at scale. Nuton has already proven its ability to rapidly move from idea to industrial production, and AWS’s data and analytics expertise will help us to accelerate optimisation and verification across operations.

“Importantly, by bringing Nuton copper into AWS’s U.S. data-centre supply chain, we’re helping to strengthen domestic resilience and secure the critical materials those facilities need, closer to where they’re used. Together we can supply the copper critical to modern data infrastructure while demonstrating how mining can contribute to more sustainable supply chains.”

Amazon’s Chief Sustainability Officer Kara Hurst said: “Amazon’s Climate Pledge goal to reach net zero carbon by 2040 requires us to innovate across every part of our operations, including how we source the materials that power our infrastructure.

“This collaboration with Nuton Technology represents exactly the kind of breakthrough we need—a fundamentally different approach to copper production that helps reduce carbon emissions and water use. As we continue to invest in next-generation carbon-free energy technology and expand our data centre operations, securing access to lower-carbon materials produced close to home strengthens both our supply chain resilience and our ability to decarbonize at scale.”

Gunnison Copper’s Johnson Camp mine in Arizona is now the lowest-carbon primary copper producer in the U.S. on the mine to refined metal basis widely used by industry. Recent third-party life cycle assessment (LCA) has confirmed Johnson Camp’s Nuton copper is expected to have a full scope carbon footprint (Scope 1+2+3) of just 2.82 kgCO₂e/kg Cu. The full-scope carbon footprint of primary copper varies by production method and technology but ranges from approximately 1.5 to 8.0 kgCO₂e/kg Cu globally.

Through the purchase of 134,000 Green-e Energy certified renewable energy certificates, Nuton ensures 100% of the site’s electricity is matched by on-site electricity consumption. Additionally, water intensity is anticipated to be 71 litres per kilogram copper, compared to the global average industry estimate of ~130 litres per kilogram of copper production[1].

The project is targeting production of approximately 30,000[2] tonnes of refined copper across a four-year deployment period.

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 | Media Relations, Australia Matt Chambers M +61 433 525 739 Alyesha Anderson M +61 434 868 118 Rachel Pupazzoni M +61 438 875 469 Bruce Tobin M +61 419 103 454 | Media Relations, Canada Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Vanessa Damha M +1 514 715 2152 |

| Investor Relations, United Kingdom Rachel Arellano M: +44 7584 609 644 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Weiwei Hu M +44 7825 907 230 | Investor Relations, Australia Tom Gallop M +61 439 353 948 Eddie Gan-Och M +976 95 091 237 | Media Relations, US & Latin America Jesse Riseborough M +1 202 394 9480 |

| Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 |

[1] Water and carbon emissions intensities for Johnson Camp and global averages have been validated by Skarn Associates, a leading provider of carbon and water intensity curves for the industry.

[2] Includes ~16kt from run of mine leaching pad and ~14kt from Nuton technology.

Copper is everywhere: in the wires that power our homes, the electronics we use daily, and the infrastructure that keeps the world moving. But how do we extract this essential metal in a way that makes sense for both the economy and the environment? Enter heap leaching, a smarter, cleaner, more efficient method of copper extraction that works hand in hand with traditional mining to maximize recovery while minimizing environmental impact. Nuton’s bio-heap leaching technology takes this process even further, using the power of bacteria to extract more copper with less chemicals and less impact on the earth.

Chemical heap leaching: process and downsides

Chemical heap leaching has been around since the 1700s, and has since been widely adopted alongside—or in place of—traditional mining techniques. By trickling a sulfuric acid solution over heaps of crushed ore, miners can extract more copper at lower costs. This method is surface-based and uses impermeable liners to prevent contamination, making it an efficient choice for many operations.

But while chemical heap leaching is effective, it comes with trade-offs. The process relies on strong chemical solutions that must be carefully managed to prevent environmental damage. Plus, producing and handling these chemicals requires energy, adding to the overall footprint of the process. It’s a step in the right direction, but there’s a better way.

Bio-heap leaching: a superior and sustainable solution

What if we could harness nature to do the heavy lifting? That’s exactly what Nuton’s bio-heap leaching technology does. Instead of relying on harsh chemicals, it uses microorganisms—tiny but mighty—to break down copper minerals more efficiently. This not only reduces the risk of contamination but also cuts down on energy use, making it a cleaner, smarter approach.

And the benefits don’t stop there. Bio-heap leaching can recover up to 85% of copper from ores, which means more copper from the same volume of material. This process helps in reducing waste and making operations more cost-effective. It’s also incredibly versatile, working on challenging sites, including brownfield and legacy mining areas, where traditional methods struggle.

“Bio-heap leaching can recover up to 85% of copper from ores, which means more copper from the same volume of material. This process helps in reducing waste and making operations more cost-effective.”

Paving the way in sustainable copper leaching

As the world’s demand for copper grows, so does the need for more sustainable ways to extract it. Nuton’s bio-heap leaching technology leads the charge, turning mining into a cleaner, more efficient process. While chemical heap leaching offers advantages, bio-heap leaching enhances them by improving recovery rates and slashing environmental impact.

Innovative leaching methods like these are paving the way for a future where mining and sustainability go hand in hand. And that’s good news for everyone.

Another round of awards honors Nuton. This time, the 2025 Mining Technology Excellence Awards honor Nuton for three awards, underscoring its role in transforming the industry through sustainable mining practices.

“We are honored by this recognition, a testament to a hard-working and dedicated Nuton team,” says Adam Burley, Nuton Chief Executive Officer. This distinction arrives as Nuton achieves First Copper production from its industrial-scale deployment at the Johnson Camp Mine in Arizona, validating its decades of research. “Nuton brings together the spark of people, the intelligence of nature, and the power of technology to open new pathways for copper production.”

Innovation Award for bioleaching technology

The Innovation Award recognizes Nuton for its groundbreaking bioleaching technology, which significantly enhances copper recovery rates. Mining Technology adds, “This combination of advanced science and applied engineering not only matches but often surpasses the performance of traditional concentrator and leach technologies, solidifying Nuton’s position as a leader in mining innovation.”

Business Expansion Award for partnership and workforce growth

The Business Expansion Award honors Nuton for strategic partnerships across the Americas that facilitate rapid growth and access to new resources. The award profile notes, “The company’s impressive growth trajectory is evidenced by a tenfold increase in its workforce, expanding from just four to over 50 experts across engineering, technology, sustainability, and commercial functions.”

Environmental Stewardship Award for reduced emissions and water usage

The Environmental Stewardship Award celebrates Nuton for its low-impact processing methods that drastically reduce emissions and improve water efficiency. The feature observes, “This innovation not only minimizes the ecological footprint of mining operations but also addresses regulatory challenges associated with land permits for tailings and long-term waste management.”

In summary, these three wins reinforce Nuton’s impact on sustainable copper mining innovation. Nuton’s technology extends mine life and maximizes resource use by extracting value from ores that would otherwise be classified as waste, increasing yield and revenue at both new and existing mines. Its environmental performance is expected to exceed that of conventional copper processing technologies, with up to 80% less water use and up to 60% lower carbon emissions than the traditional concentrator route.

The Mining Technology Excellence Awards honor the most significant achievements and innovations in the global mining industry. Powered by GlobalData’s business intelligence, the Awards recognize the people and companies driving positive change and shaping the industry’s future.

Nuton’s first copper milestone marks a new era of smarter, cleaner, copper production

After decades of research and innovation, Nuton has achieved a major milestone: producing its first copper cathode using its industry-leading bioleaching technology at Johnson Camp Mine (JCM) in Arizona.

What began in a small lab in Bundoora, Australia, has scaled to full industrial operations – proving that cleaner, smarter copper production is possible at industrial scale.

“This is a pivotal moment for Nuton,” says Adam Burley, Nuton CEO. “We’re not just advancing technology – we’re setting a new standard for the industry and proving what’s possible: fast and at scale. We are incredibly proud of the team and excited for what is to come, which is validating and sustaining the technology’s performance.”

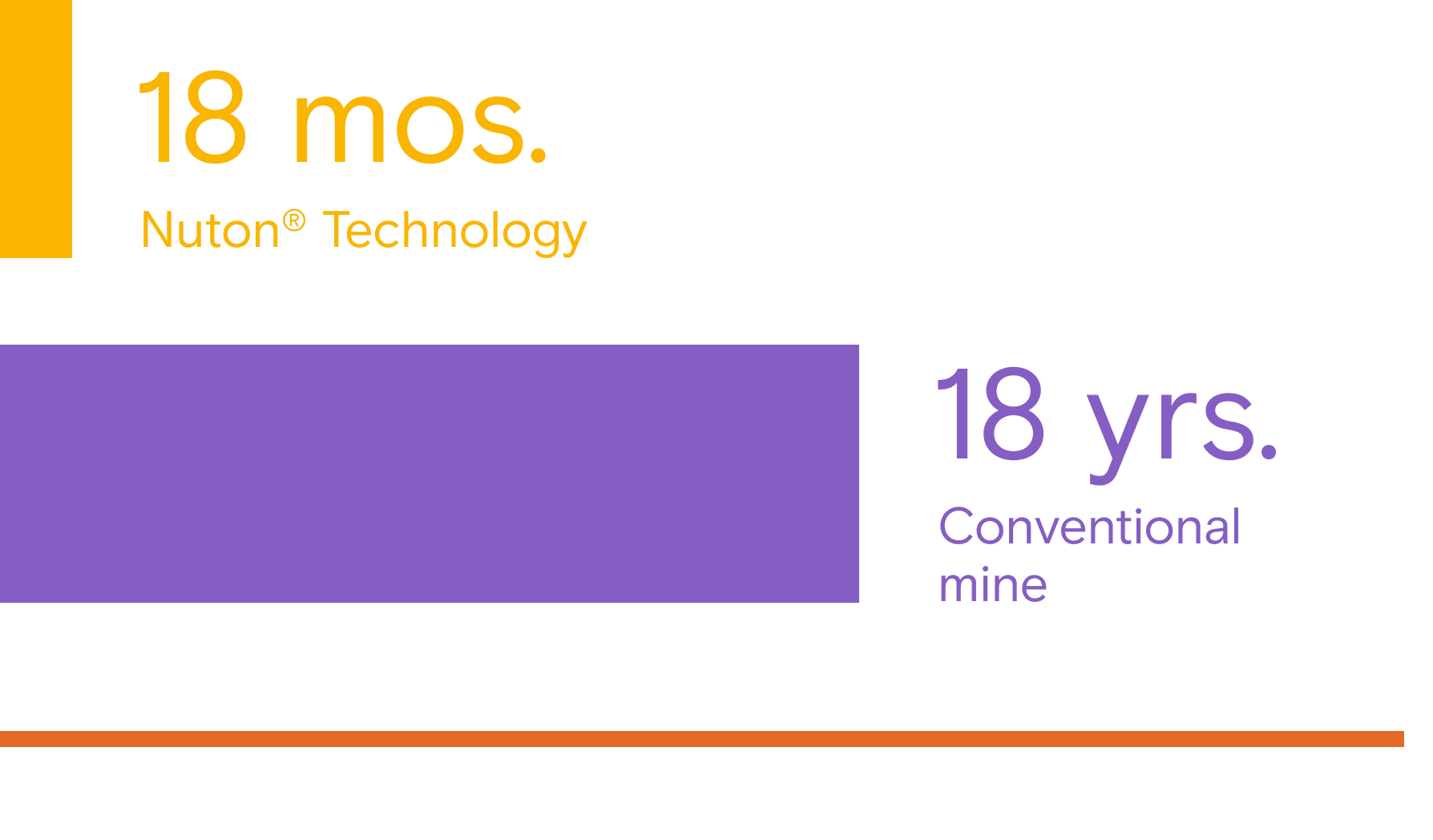

This milestone marks Nuton’s official entry into commercial operations and is a pivotal step in redefining how copper is produced. The Nuton® technology enabled the restart of JCM, owned by Gunnison Copper Corp, and moved from concept to cathode in just 18 months.

Go inside Nuton’s first copper

Watch how this milestone mine-to-market technology is reshaping the copper industry.

Rapid scale-up: concept to cathode in 18 months

One of the most significant aspects of Nuton’s achievement is the speed of its progress – from concept to cathode in just 18 months – an unprecedented speed in Rio Tinto. This included recommissioning the mine, constructing new infrastructure, and deploying proprietary equipment.

Nuton’s approach is different from the norm – offering a modular ‘brick-like’ system that can be deployed as part of a technology package that integrates biology with chemistry, engineering, and digital tools. By embedding advanced systems like AI, data analytics, and adaptive process controls into every layer of the JCM operations, Nuton is building a truly intelligent, responsive system. This digital backbone enables predictive insights and continuous improvement, making the system not only efficient but intelligent.

Pioneering the science of smarter copper: up to 85% recovery and unlocking copper faster

At the heart of this achievement is Nuton’s revolutionary technology, which harnesses the power of naturally occurring bacteria to extract copper from ores. These microbes are grown in Nuton’s proprietary bioreactors and then added to heaps of crushed ore. They speed up the breakdown of minerals, creating heat and allowing copper to dissolve into a liquid solution, which is then refined into copper cathodes that are 99.99% pure.

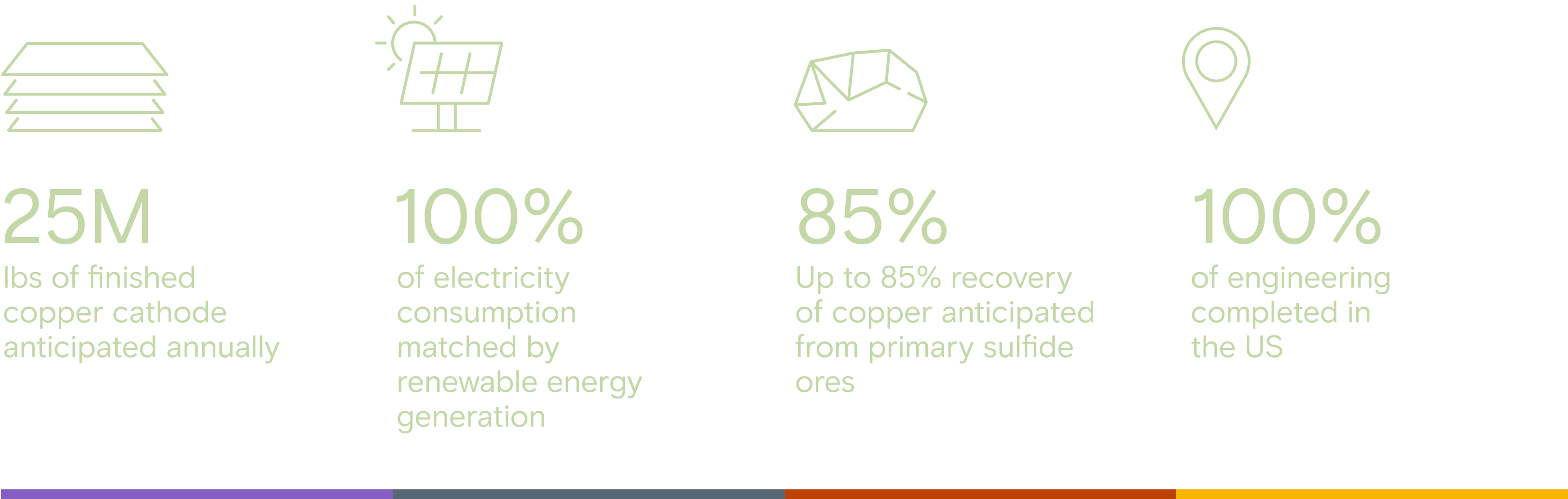

And a key differentiator? Up to 85% recovery of copper from primary sulfide ores – often considered too complex or uneconomical to process – where over 70% of the world’s untapped copper lies.

Transforming the copper industry with the lowest-carbon copper in the US

Nuton’s technology, along with investment in renewable technology, will position JCM to become the lowest-carbon copper producer among US copper mines.

A new three-year investment in Renewable Energy Certificates ensures that 100% of JCM’s electricity consumption is matched by U.S. or Canadian renewable energy generation, mitigating all Scope 2 emissions.

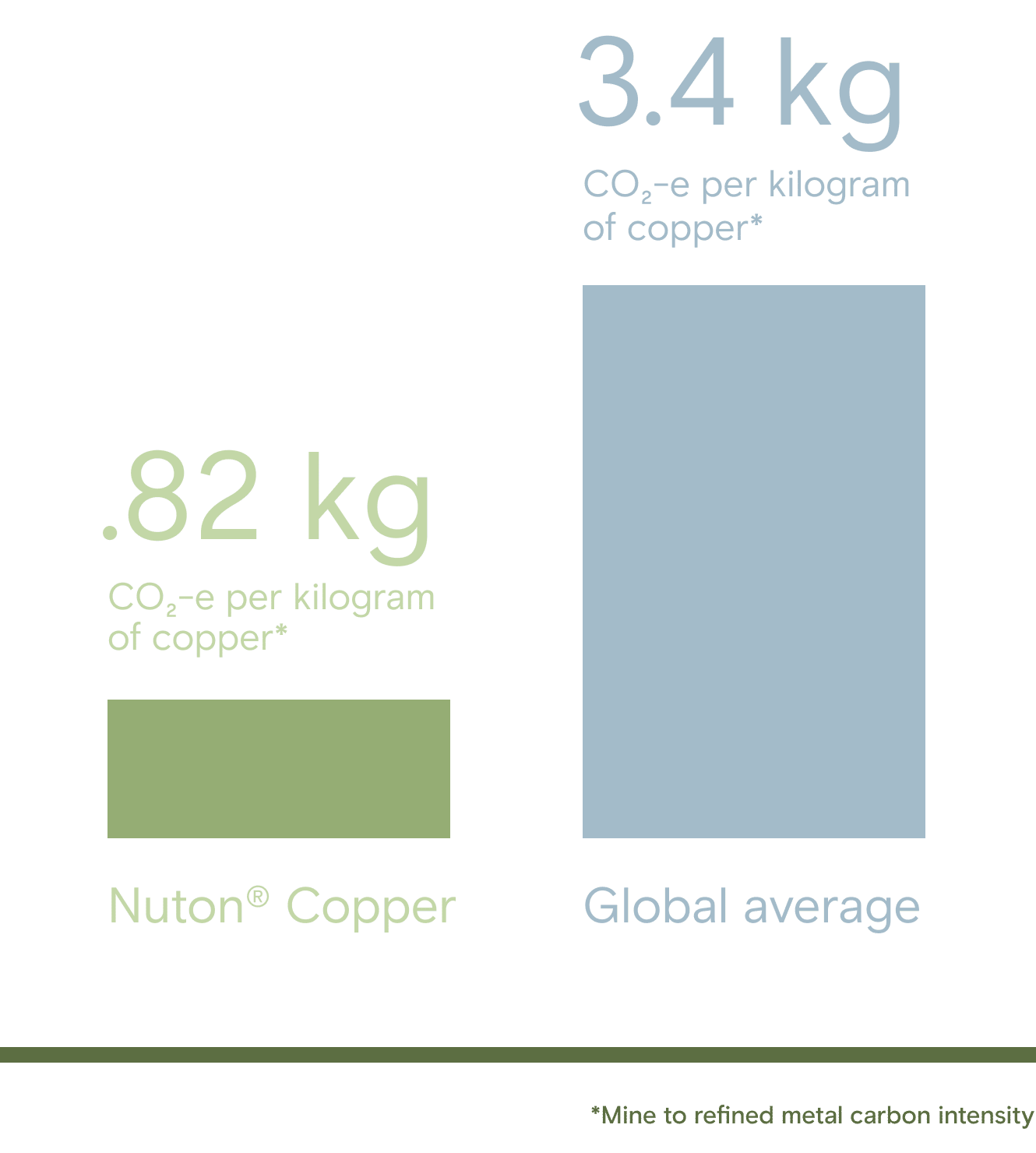

A recent ISO-certified Life Cycle Assessment (LCA) prepared for JCM indicates copper produced at site, combined with the purchase of RECs, will result in a mine-to-metal carbon footprint of just 0.82kg CO2-e per kilogram of copper, compared to the projected 2026 global of 3.4 kg CO2-e per kilogram of copper.

Centennial plant (Agave Americana) at JCM

First copper by the numbers

The big picture: closing the US copper supply gap

This milestone will help enable a more resilient domestic copper supply chain – critical for the world’s energy transition, national defense, and advanced manufacturing. With US copper demand projected to grow more than 48% over the next decade, and approximately half of refined copper currently being imported, the Nuton technology provides a pathway to help close the domestic supply gap.

By producing the copper cathode at the mine site, the Nuton process eliminates the need for smelting and refining elsewhere – a major advantage as the US lacks capacity for refining copper. Nuton’s process streamlines the journey from mine to market, reducing the reliance on foreign processing and shortening the supply chain.

The project has already resulted in the sale of approximately 100 tons of copper cathode to North American customers, generating Nuton’s first revenue. The Johnson Camp operation is designed to ramp up toward its capacity of 25 million pounds of finished copper cathode annually.

This is just the beginning: validating long-term performance

Nuton’s technology is rapidly scaling, with 11 partnerships across five countries. The next phase at JCM focuses on a critical journey of validating long-term technical performance backed by sustained production.

Rio Tinto has successfully produced the first copper from the Johnson Camp mine in Arizona using its Nuton® Technology, marking a pivotal step forward in the development of this innovative copper processing technology.

After more than 30 years of research and development, the first copper cathode using Rio Tinto’s proprietary bioleaching technology, which relies on microorganisms grown on site, was produced at Gunnison Copper’s Johnson Camp mine last month. The deployment involves the design and delivery of a technology package for a heap leach pad targeting production of approximately 30,000 tonnes of refined copper over a four-year demonstration period. Rio Tinto is engaging with several potential customers in the U.S. to support the domestic copper supply chain.

Rio Tinto Copper Chief Executive Katie Jackson said, “This is a breakthrough achievement for our Nuton technology, which is proving that cleaner, faster, and more efficient copper production is possible at an industrial scale. In an industry where projects typically take about 18 years to move from concept to production, Nuton has now proven its ability to do this in just 18 months.

“Nuton has designed a modular system deployed as a technology package integrating biology, chemistry, engineering, and digital tools, allowing it to be rapidly scaled and tailored to different ore bodies, unlocking resources that have historically been considered uneconomic or challenging. We are actively partnering on projects in North and South America to assess the potential for future deployment at additional sites in the coming years.”

Nuton relies on naturally occurring microorganisms to extract copper from primary sulphide ores, which are traditionally difficult to process. These microbes, grown at large scale in Nuton’s proprietary bioreactors, accelerate the oxidation of minerals in the crushed ore heap, generating heat and enabling copper to dissolve into a leach solution, which is then processed into 99.99% pure copper cathode.

Significantly, processing copper ore with Nuton eliminates the need for concentration, smelting and refining, shortening supply chains and delivering copper cathode at the mine gate. It achieves recovery rates of up to 85% from primary sulphides, the most abundant copper bearing ores in the world.

Nuton can also extend mine life and maximize resource use by extracting value from ores that would otherwise be classified as waste, increasing yield and revenue at both new and existing mines. Its environmental performance is expected to exceed conventional copper processing technologies, with up to 80% less water usage and up to 60% lower carbon emissions than the traditional concentrator route.

At Johnson Camp, Nuton aims to produce copper with the lowest carbon footprint in the U.S. Through the purchase of 134,000 Green-e Energy certified renewable energy certificates, Nuton ensures 100% of the site’s electricity is matched by renewable sources. The copper produced is anticipated to have a mine-to-metal carbon footprint of 0.82-kilogram CO₂-e per kilogram copper, the lowest in the U.S. and substantially lower than the projected 2026 global average of 3.4 kilograms CO₂-e per kilogram among operating copper mines. Additionally, water intensity is anticipated to be 71 litres per kilogram copper, compared to the global average industry estimate of ~130 litres per kilogram of copper production.

Gunnison Copper Chief Executive Officer and President Stephen Twyerould said, “The first production of Nuton copper at Johnson Camp is the culmination of exceptional teamwork between Gunnison Copper and Rio Tinto’s Nuton team. Achieving this level of performance in such a short time frame shows what is possible when innovation, operational excellence, and a shared vision come together. With Nuton copper now entering the U.S. supply chain, this milestone underscores the critical role we can play in strengthening domestic access to cleaner, low-carbon copper.”

While this milestone confirms Nuton’s engineering and operational viability, the next phase will focus on validating long-term technical performance. This includes multi-year testing, independent third-party verification, and internal review by Rio Tinto to ensure consistent recovery rates and environmental performance.

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 | Media Relations, Australia Matt Chambers M +61 433 525 739 Alyesha Anderson M +61 434 868 118 Rachel Pupazzoni M +61 438 875 469 Bruce Tobin M +61 419 103 454 | Media Relations, Canada Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Vanessa Damha M +1 514 715 2152 |

| Investor Relations, United Kingdom Rachel Arellano M: +44 7584 609 644 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Weiwei Hu M +44 7825 907 230 | Investor Relations, Australia Tom Gallop M +61 439 353 948 Eddie Gan-Och M +976 95 091 237 | Media Relations, US & Latin America Jesse Riseborough M +1 202 394 9480 |

| Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 |