Nuton’s first copper milestone marks a new era of smarter, cleaner, copper production

After decades of research and innovation, Nuton has achieved a major milestone: producing its first copper cathode using its industry-leading bioleaching technology at Johnson Camp Mine (JCM) in Arizona.

What began in a small lab in Bundoora, Australia, has scaled to full industrial operations – proving that cleaner, smarter copper production is possible at industrial scale.

“This is a pivotal moment for Nuton,” says Adam Burley, Nuton CEO. “We’re not just advancing technology – we’re setting a new standard for the industry and proving what’s possible: fast and at scale. We are incredibly proud of the team and excited for what is to come, which is validating and sustaining the technology’s performance.”

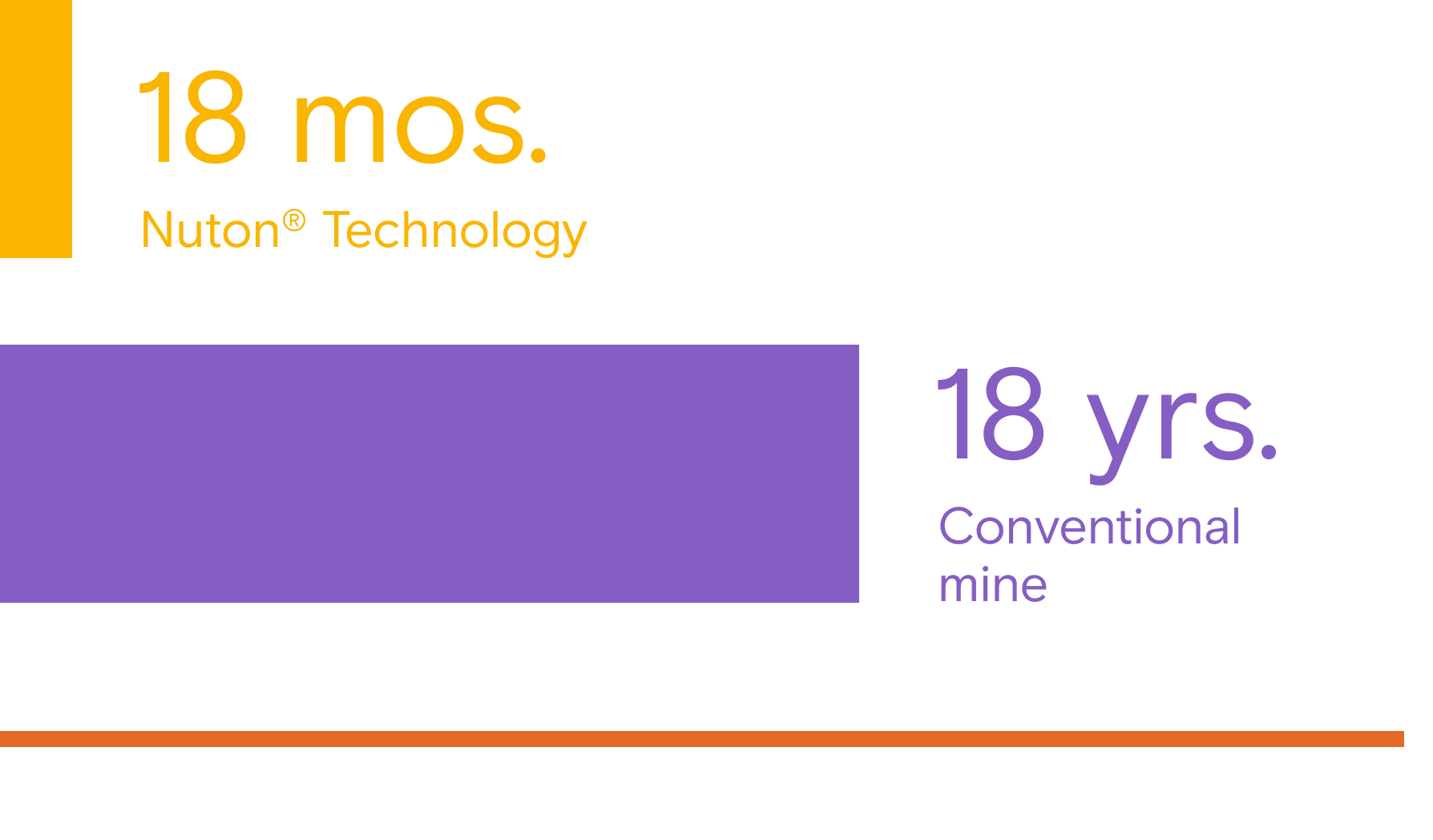

This milestone marks Nuton’s official entry into commercial operations and is a pivotal step in redefining how copper is produced. The Nuton® technology enabled the restart of JCM, owned by Gunnison Copper Corp, and moved from concept to cathode in just 18 months.

Go inside Nuton’s first copper

Watch how this milestone mine-to-market technology is reshaping the copper industry.

Rapid scale-up: concept to cathode in 18 months

One of the most significant aspects of Nuton’s achievement is the speed of its progress – from concept to cathode in just 18 months – an unprecedented speed in Rio Tinto. This included recommissioning the mine, constructing new infrastructure, and deploying proprietary equipment.

Nuton’s approach is different from the norm – offering a modular ‘brick-like’ system that can be deployed as part of a technology package that integrates biology with chemistry, engineering, and digital tools. By embedding advanced systems like AI, data analytics, and adaptive process controls into every layer of the JCM operations, Nuton is building a truly intelligent, responsive system. This digital backbone enables predictive insights and continuous improvement, making the system not only efficient but intelligent.

Pioneering the science of smarter copper: up to 85% recovery and unlocking copper faster

At the heart of this achievement is Nuton’s revolutionary technology, which harnesses the power of naturally occurring bacteria to extract copper from ores. These microbes are grown in Nuton’s proprietary bioreactors and then added to heaps of crushed ore. They speed up the breakdown of minerals, creating heat and allowing copper to dissolve into a liquid solution, which is then refined into copper cathodes that are 99.99% pure.

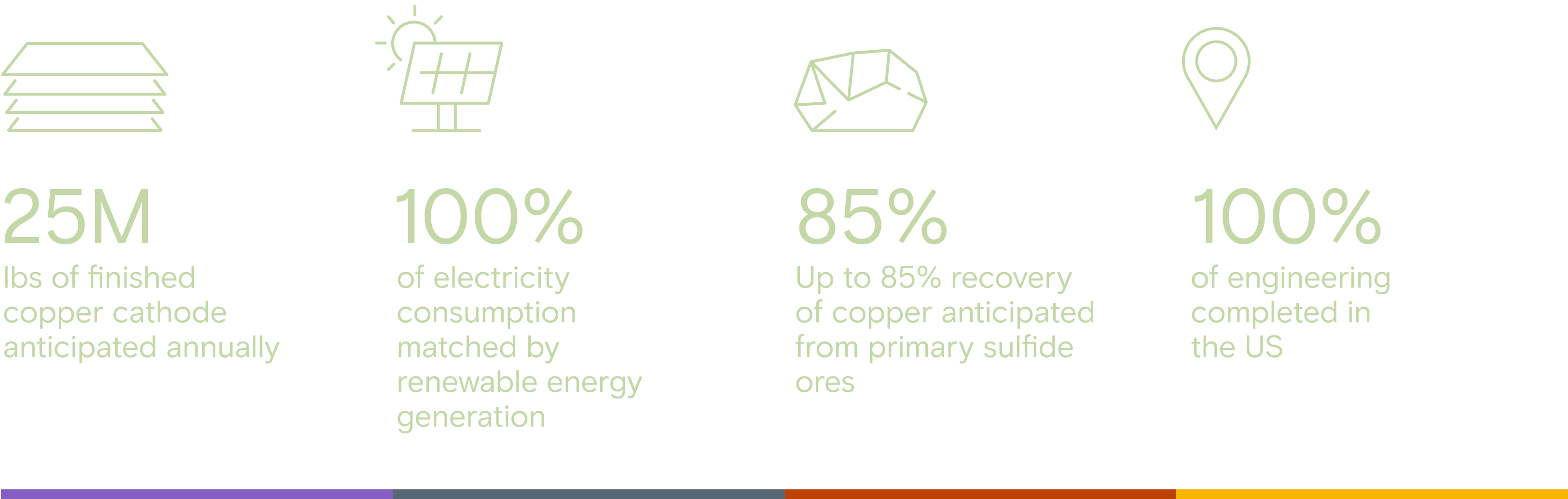

And a key differentiator? Up to 85% recovery of copper from primary sulfide ores – often considered too complex or uneconomical to process – where over 70% of the world’s untapped copper lies.

Transforming the copper industry with the lowest-carbon copper in the US

Nuton’s technology, along with investment in renewable technology, will position JCM to become the lowest-carbon copper producer among US copper mines.

A new three-year investment in Renewable Energy Certificates ensures that 100% of JCM’s electricity consumption is matched by U.S. or Canadian renewable energy generation, mitigating all Scope 2 emissions.

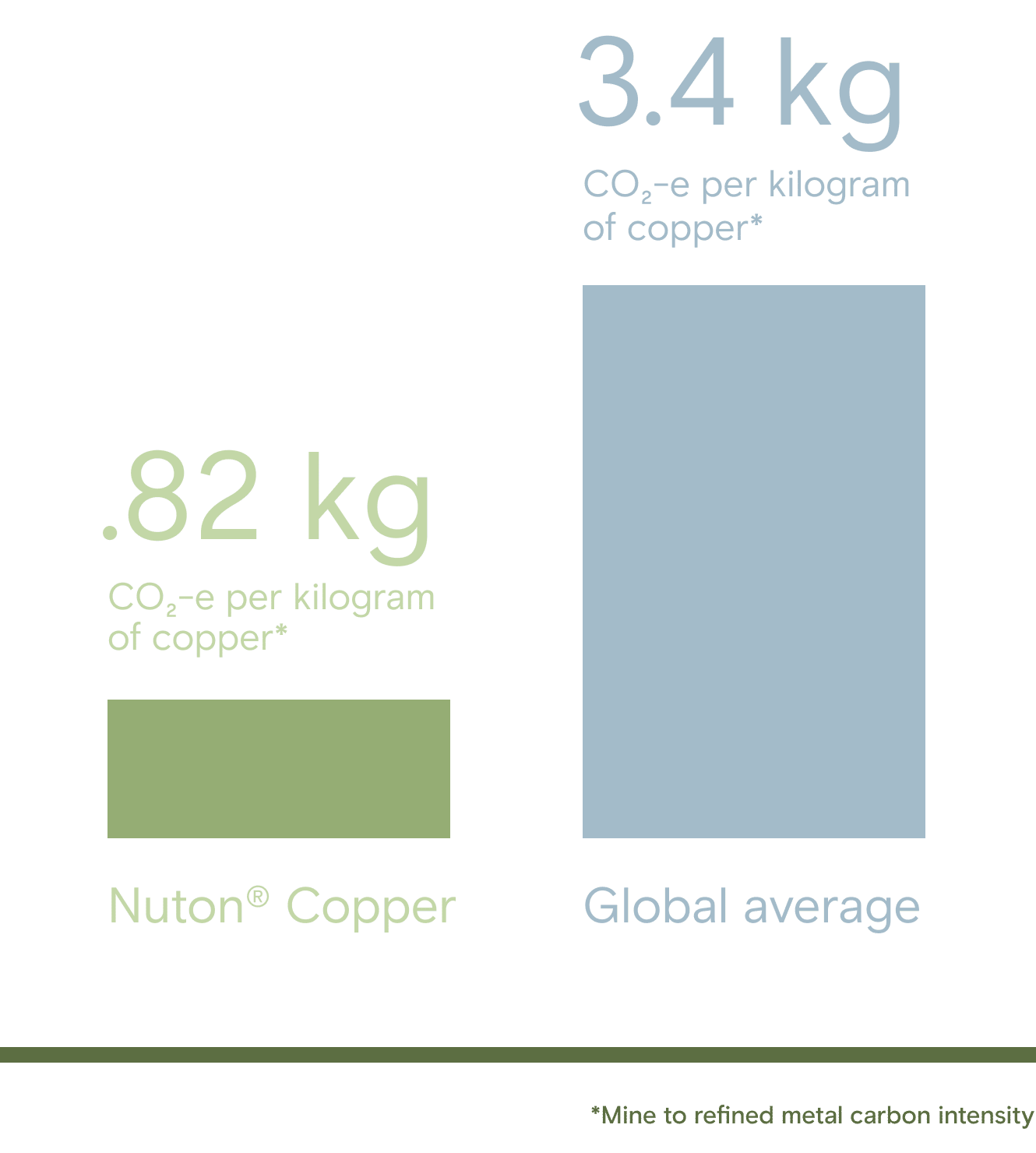

A recent ISO-certified Life Cycle Assessment (LCA) prepared for JCM indicates copper produced at site, combined with the purchase of RECs, will result in a mine-to-metal carbon footprint of just 0.82kg CO2-e per kilogram of copper, compared to the projected 2026 global of 3.4 kg CO2-e per kilogram of copper.

Centennial plant (Agave Americana) at JCM

First copper by the numbers

The big picture: closing the US copper supply gap

This milestone will help enable a more resilient domestic copper supply chain – critical for the world’s energy transition, national defense, and advanced manufacturing. With US copper demand projected to grow more than 48% over the next decade, and approximately half of refined copper currently being imported, the Nuton technology provides a pathway to help close the domestic supply gap.

By producing the copper cathode at the mine site, the Nuton process eliminates the need for smelting and refining elsewhere – a major advantage as the US lacks capacity for refining copper. Nuton’s process streamlines the journey from mine to market, reducing the reliance on foreign processing and shortening the supply chain.

The project has already resulted in the sale of approximately 100 tons of copper cathode to North American customers, generating Nuton’s first revenue. The Johnson Camp operation is designed to ramp up toward its capacity of 25 million pounds of finished copper cathode annually.

This is just the beginning: validating long-term performance

Nuton’s technology is rapidly scaling, with 11 partnerships across five countries. The next phase at JCM focuses on a critical journey of validating long-term technical performance backed by sustained production.

Rio Tinto has successfully produced the first copper from the Johnson Camp mine in Arizona using its Nuton® Technology, marking a pivotal step forward in the development of this innovative copper processing technology.

After more than 30 years of research and development, the first copper cathode using Rio Tinto’s proprietary bioleaching technology, which relies on microorganisms grown on site, was produced at Gunnison Copper’s Johnson Camp mine last month. The deployment involves the design and delivery of a technology package for a heap leach pad targeting production of approximately 30,000 tonnes of refined copper over a four-year demonstration period. Rio Tinto is engaging with several potential customers in the U.S. to support the domestic copper supply chain.

Rio Tinto Copper Chief Executive Katie Jackson said, “This is a breakthrough achievement for our Nuton technology, which is proving that cleaner, faster, and more efficient copper production is possible at an industrial scale. In an industry where projects typically take about 18 years to move from concept to production, Nuton has now proven its ability to do this in just 18 months.

“Nuton has designed a modular system deployed as a technology package integrating biology, chemistry, engineering, and digital tools, allowing it to be rapidly scaled and tailored to different ore bodies, unlocking resources that have historically been considered uneconomic or challenging. We are actively partnering on projects in North and South America to assess the potential for future deployment at additional sites in the coming years.”

Nuton relies on naturally occurring microorganisms to extract copper from primary sulphide ores, which are traditionally difficult to process. These microbes, grown at large scale in Nuton’s proprietary bioreactors, accelerate the oxidation of minerals in the crushed ore heap, generating heat and enabling copper to dissolve into a leach solution, which is then processed into 99.99% pure copper cathode.

Significantly, processing copper ore with Nuton eliminates the need for concentration, smelting and refining, shortening supply chains and delivering copper cathode at the mine gate. It achieves recovery rates of up to 85% from primary sulphides, the most abundant copper bearing ores in the world.

Nuton can also extend mine life and maximize resource use by extracting value from ores that would otherwise be classified as waste, increasing yield and revenue at both new and existing mines. Its environmental performance is expected to exceed conventional copper processing technologies, with up to 80% less water usage and up to 60% lower carbon emissions than the traditional concentrator route.

At Johnson Camp, Nuton aims to produce copper with the lowest carbon footprint in the U.S. Through the purchase of 134,000 Green-e Energy certified renewable energy certificates, Nuton ensures 100% of the site’s electricity is matched by renewable sources. The copper produced is anticipated to have a mine-to-metal carbon footprint of 0.82-kilogram CO₂-e per kilogram copper, the lowest in the U.S. and substantially lower than the projected 2026 global average of 3.4 kilograms CO₂-e per kilogram among operating copper mines. Additionally, water intensity is anticipated to be 71 litres per kilogram copper, compared to the global average industry estimate of ~130 litres per kilogram of copper production.

Gunnison Copper Chief Executive Officer and President Stephen Twyerould said, “The first production of Nuton copper at Johnson Camp is the culmination of exceptional teamwork between Gunnison Copper and Rio Tinto’s Nuton team. Achieving this level of performance in such a short time frame shows what is possible when innovation, operational excellence, and a shared vision come together. With Nuton copper now entering the U.S. supply chain, this milestone underscores the critical role we can play in strengthening domestic access to cleaner, low-carbon copper.”

While this milestone confirms Nuton’s engineering and operational viability, the next phase will focus on validating long-term technical performance. This includes multi-year testing, independent third-party verification, and internal review by Rio Tinto to ensure consistent recovery rates and environmental performance.

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 | Media Relations, Australia Matt Chambers M +61 433 525 739 Alyesha Anderson M +61 434 868 118 Rachel Pupazzoni M +61 438 875 469 Bruce Tobin M +61 419 103 454 | Media Relations, Canada Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Vanessa Damha M +1 514 715 2152 |

| Investor Relations, United Kingdom Rachel Arellano M: +44 7584 609 644 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Weiwei Hu M +44 7825 907 230 | Investor Relations, Australia Tom Gallop M +61 439 353 948 Eddie Gan-Och M +976 95 091 237 | Media Relations, US & Latin America Jesse Riseborough M +1 202 394 9480 |

| Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 | Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 |

VANCOUVER, CANADA (November 24, 2025) – Aldebaran Resources Inc. (“Aldebaran” or the “Company”) (TSX-V: ALDE, OTCQX: ADBRF) is pleased to announce the filing on SEDAR+ of an updated Technical Report and Preliminary Economic Assessment (the “Altar PEA”) on the Altar copper-gold project located in San Juan Province, Argentina, prepared in accordance with National Instrument 43-101 – Standards of Disclosure in Mineral Projects. The Altar PEA has an effective date of September 1, 2025, and was created by SRK Consulting Inc. as lead consultants with Knight Piesold as a subcontractor. The report titled “Preliminary Economic Assessment, Altar Project, San Juan, Argentina” has been filed on the SEDAR+ website at www.sedarplus.ca and will be posted on the Company’s website at www.aldebaranresources.com.

Additionally, the Company announces that Nuton Holdings Ltd., a Rio Tinto venture (“Nuton”), has provided notice of termination of the option to joint venture agreement announced on November 7, 2024, under which Nuton had the right to acquire a 20% interest in the Altar project. Nuton’s decision comes as they are shifting priorities to focus on later-stage projects that could potentially deliver nearer-term production. Despite the termination, Nuton and Aldebaran could still enter a licensing agreement to deploy the Nuton® Technology, proprietary bio-leaching technology, at Altar.

John Black, Chief Executive Officer and Director of Aldebaran, commented: “The PEA demonstrated that the base case concentrator scenario for Altar is a long-life project delivering significant copper, gold, and silver production at attractive cash costs while minimizing upfront capital. With an NPV (8%) of US$2 billion and an IRR of 20.5%, we believe that Altar is an attractive large-scale copper gold project and a very important project for Argentina moving forward. We thank Nuton for their participation in the Altar project and understand that their shift in priorities made continuing with the Altar option agreement challenging. We retain an 80% interest in the project and look forward to advancing it towards a pre-feasibility study with our joint venture partner Sibanye-Stillwater.”

Qualified Person

The scientific and technical data contained in this news release has been reviewed and approved by Dr. Kevin B. Heather, B.Sc. (Hons), M.Sc, Ph.D, FAusIMM, FGS, Chief Geological Officer and director of Aldebaran, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

ON BEHALF OF THE ALDEBARAN BOARD

(signed) “John Black”

John Black

Chief Executive Officer and Director

Tel: +1 (604) 685-6800

Email: info@aldebaranresources.com

Please click here and subscribe to receive future news releases: https://aldebaranresources.com/contact/subscribe/

For further information, please consult our website at www.aldebaranresources.com or contact:

Ben Cherrington

Manager, Investor Relations

Phone: +1 347 394-2728 or +44 7538 244 208

Email: ben.cherrington@aldebaranresources.com

About Aldebaran Resources Inc.

Aldebaran is a mineral exploration company that was spun out of Regulus Resources Inc. in 2018 and has the same core management team. Aldebaran holds an 80% interest in the Altar copper-gold project in San Juan Province, Argentina. The Altar project hosts multiple porphyry copper-gold deposits with potential for additional discoveries. Altar forms part of a cluster of world-class porphyry copper deposits which includes Los Pelambres (Antofagasta Minerals), El Pachón (Glencore), and Los Azules (McEwen Copper). In November 2024 the Company announced an updated mineral resource estimate for Altar, prepared by Independent Mining Consultants Inc. and based on the drilling completed up to and including the 2023-24 field season (independent technical report prepared by Independent Mining Consultants Inc., Tucson, Arizona, titled “Technical Report, Estimated Mineral Resources, Altar Project, San Juan Province, Argentina”, dated December 31, 2024 – see news release dated November 25, 2024).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains “forward-looking information” or forward-looking statements” within the meaning of Canadian and United States securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the Altar project as a profitable project for the Company, the scale, throughput, resources, projected production and projected profitability of the Altar project, completion of a pre-feasibility study, and projected economics, including NPV, IRR, and cash costs, are forward-looking. Generally, the forward-looking information and forward looking statements can be identified by the use of forward looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, “will continue” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this news release.

Forward looking information and forward-looking statements, while based on management’s best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Aldebaran to be materially different from those expressed or implied by such forward-looking information or forward-looking statements. Although Aldebaran has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements. The Company has and continues to disclose in its Management’s Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking information and forward-looking statements and to the validity of the information, in the period the changes occur. The forward-looking statements and forward-looking information are made as of the date hereof and Aldebaran disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements or forward-looking information contained herein to reflect future results. Accordingly, readers should not place undue reliance on forward-looking statements and information.

The mining world just recognized a radical shift in copper production. Nuton earned Mining Magazine‘s 2025 Technology & Innovation Award, validating its pioneering bioleaching process and its immediate, positive impact on the copper sector’s environmental profile.

The award acknowledges Nuton’s superior performance, rapid on-site deployment, and advanced bioleaching technology. The award judges declare, “In a world of falling grades, a process that can make copper sulphides economically attractive is a massive achievement.”

In celebration of the Mining Award for Technology & Innovation award, Nuton CEO Adam Burley sat down with Mining Magazine’s Dominic Hale to discuss the evolution of copper production. Watch the full conversation below.

The annual Mining Magazine Awards recognize outstanding achievements, projects and technologies. They cover various categories such as Mineral Processing, Drill & Blast, Bulk Handling and Net Zero Achievement, honoring companies and individuals for their innovation, efficiency and safety advancements.

VANCOUVER, CANADA (October 30, 2025) – Aldebaran Resources Inc. (“Aldebaran” or the “Company”) (TSX-V: ALDE, OTCQX: ADBRF) is pleased to announce the results of a Preliminary Economic Assessment (“PEA”), prepared in accordance with National Instrument 43-101 standards, for the Altar copper-gold project located in San Juan, Argentina. The base case scenario utilizes a 60,000 tonnes per day (“tpd”) concentrator, processing mineralized material from both open pit and underground sources. The results of the PEA are reported on a 100% basis, while Aldebaran owns an 80% interest in the project, with the remaining 20% held by Sibanye-Stillwater Ltd.

All dollar amounts referenced herein are in US dollars unless otherwise noted.

HIGHLIGHTS

Long life operation with significant production:

- 48-year mine life, including 3 years of construction

- First 20 years1: Average annual production of 121,445 tonnes copper equivalent2 (“CuEq”)

- 108,579 tonnes copper (“Cu”), 43,199 ounces of gold (“Au”), and 570,217 ounces of silver (“Ag”)

- First 30 years1: Average annual production of 116,294 tonnes CuEq

- 105,897 tonnes Cu, 33,866 ounces of Au, and 557,239 ounces of Ag

- LOM: Average annual production of 101,413 tonnes CuEq

- 92,891 tonnes Cu, 27,020 ounces of Au, and 525,192 ounces of Ag

Robust economics with leverage to commodity prices:

- Using base-case metal prices of $4.35/lb Cu, $2,500/oz Au, and $27/oz Ag, the project has an after-tax NPV (8%) of $2.0 billion, an IRR of 20.5% and a payback period of 4 years

- Total LOM gross revenue of $44.7 billion (before TC/RCs, payabilities and transport) and total LOM free cash flow of $10.7 billion

- Using spot prices of $5.00/lb Cu, $3,963/oz Au, and $47/oz Ag, the project has an after-tax NPV (8%) of $3.34 billion and an IRR of 28.0%4

Attractive capital intensity:

- Initial capex for the project is $1.59 billion

- Upfront capital is minimized by taking a staged approach to the tailings storage facility and underground construction

- Capital intensity of $15,713/t of average annual CuEq metal produced3

- NPV @ 8% / Initial Capex ratio of 1.27x

Competitive cost profile:

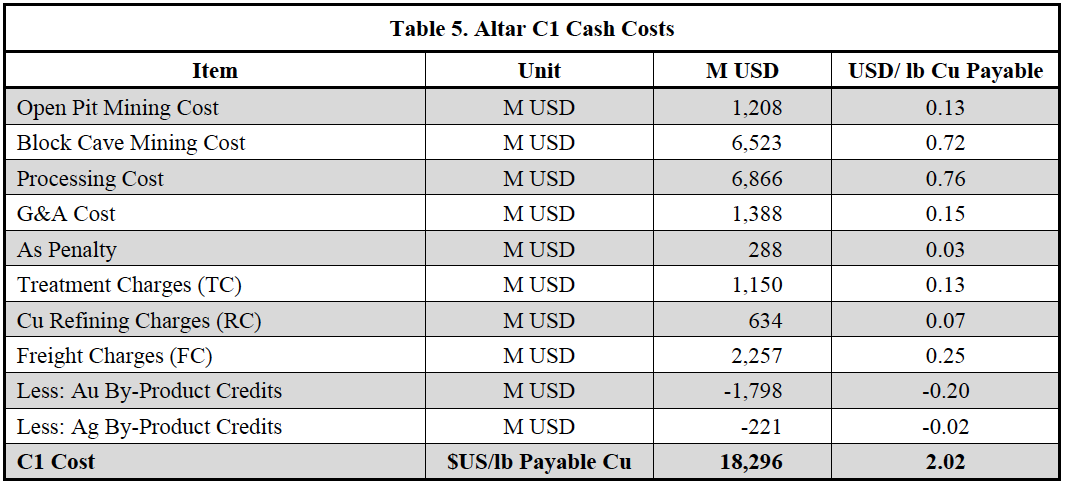

- Cash Costs (C1) of $1.71/lb payable Cu for the first 20 years1, $1.87/lb payable Cu for the first 30 years1, and $2.02/lb payable Cu for the LOM

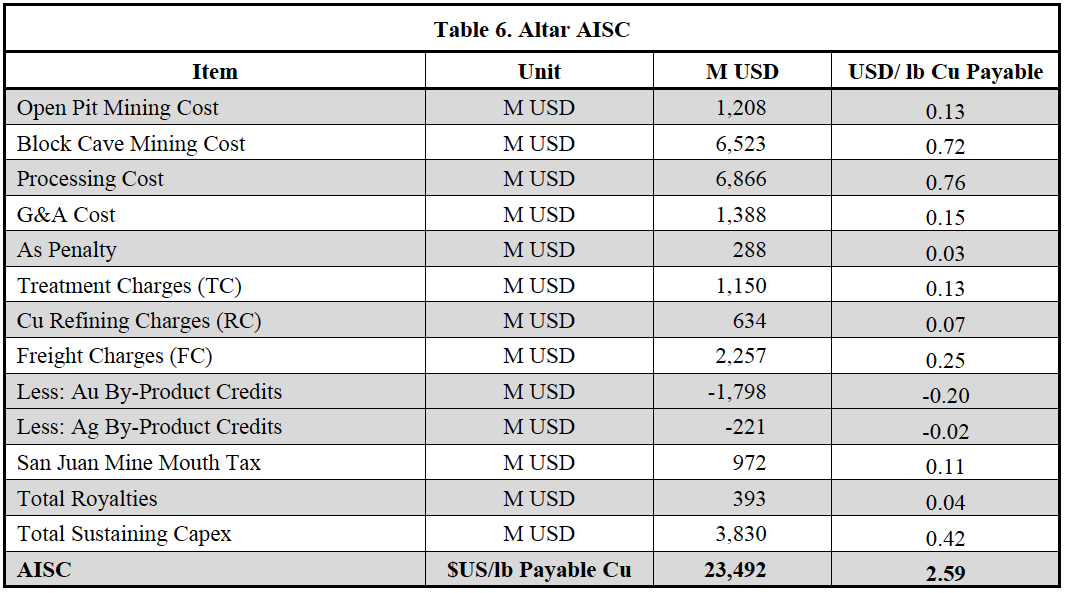

- All in Sustaining Costs (“AISC”) of $2.25/lb payable Cu for the first 20 years1, $2.42/lb payable Cu for the first 30 years1, and $2.59/lb payable Cu for the LOM

Combined Open Pit and Underground Operation:

- Production from the open pit pays back the initial capital, while development of the underground is ongoing

- Underground mining pulls forward better grade mineralization earlier in the mine life, to increase production and generate cash flow

- ~80% of the resources (by tonnage) in the mine plan are categorized as Measured and Indicated, with the remaining ~20% categorized as Inferred

John Black, Chief Executive Officer of Aldebaran, commented: “This PEA confirms that the Altar project has the potential to become a long-life, high-quality copper operation capable of generating substantial production and cash flow. Our objective was to define a mine plan that delivers a minimum of 100,000 tonnes of CuEq per year, while maintaining a compact operational footprint and a disciplined approach to capital. The results of this study clearly achieve those objectives and demonstrate that Altar is a technically and economically robust project. This PEA represents a major milestone for the Company and provides the foundation for our upcoming application for inclusion under Argentina’s RIGI investment framework. With the political environment in Argentina shifting toward pro-business and pro-development policies—as underscored by the recent mid-term election results—the timing for advancing a project of Altar’s scale could not be better. The country is positioning itself to emerge as a significant copper producer at a time when global demand for the metal continues to rise. In addition to the base case concentrator scenario, our collaboration with Nuton, a Rio Tinto venture, demonstrates Nuton® Technology as a potentially viable processing alternative at Altar. Utilizing Nuton® Technology, life-of-mine capital expenditure and operating costs were reduced, leading to higher life-of-mine free cash flow. When you combine the economic results with the ESG benefits of Nuton’s sulphide leaching technology, the Nuton case is quite compelling and warrants further evaluation. The next 12 to 18 months will be transformative for the Company, with multiple key catalysts—including a resource update, completion of the PFS, and the proposed Centauri Minerals spin-out—positioning us to unlock significant value for our shareholders.”

Kevin B. Heather, Chief Geological Officer of Aldebaran, commented: “The PEA represents a significant milestone for the Altar project. In addition to achieving the goals John stated above, we were also focused on maximizing NPV and IRR, hence we elected to move forward with a mine plan that included a combination of open-pit and underground block caving. The block cave, commencing production after the open pit pays back the initial capital, allows us to pull forward higher-grade material in the mine plan and to maintain constant CuEq production numbers, while keeping throughput at 60,000 tpd. Moreover, it keeps the overall footprint of the operation smaller, which is a key consideration for development projects. Our approach to capital expenditures was to stage capital outlays where possible, to ensure initial capital expenditures were kept manageable. Where possible, capital was paid out of cash flow to present a more prudent and attractive development opportunity. We will now begin to shift our focus to the PFS, which will be the next step in de-risking the Altar project. To that end, our 2025/2026 field program is now underway, with most of the work focused on collecting the additional data necessary for the upcoming PFS. This includes additional infill drilling, geotechnical drilling, lab-based geotechnical stress and strain test work, Acid Based Accounting (ABA) test work, environmental monitoring, water wells, water balance studies, community engagement, and more. While this work is ongoing, we will also be exploring several opportunities that we have identified that could potentially unlock additional value from the Altar Project.”

PEA Overview

When available, readers are encouraged to read the PEA in the Company’s technical report (“Technical Report”) prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“43-101”) in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA and mineral resource model. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

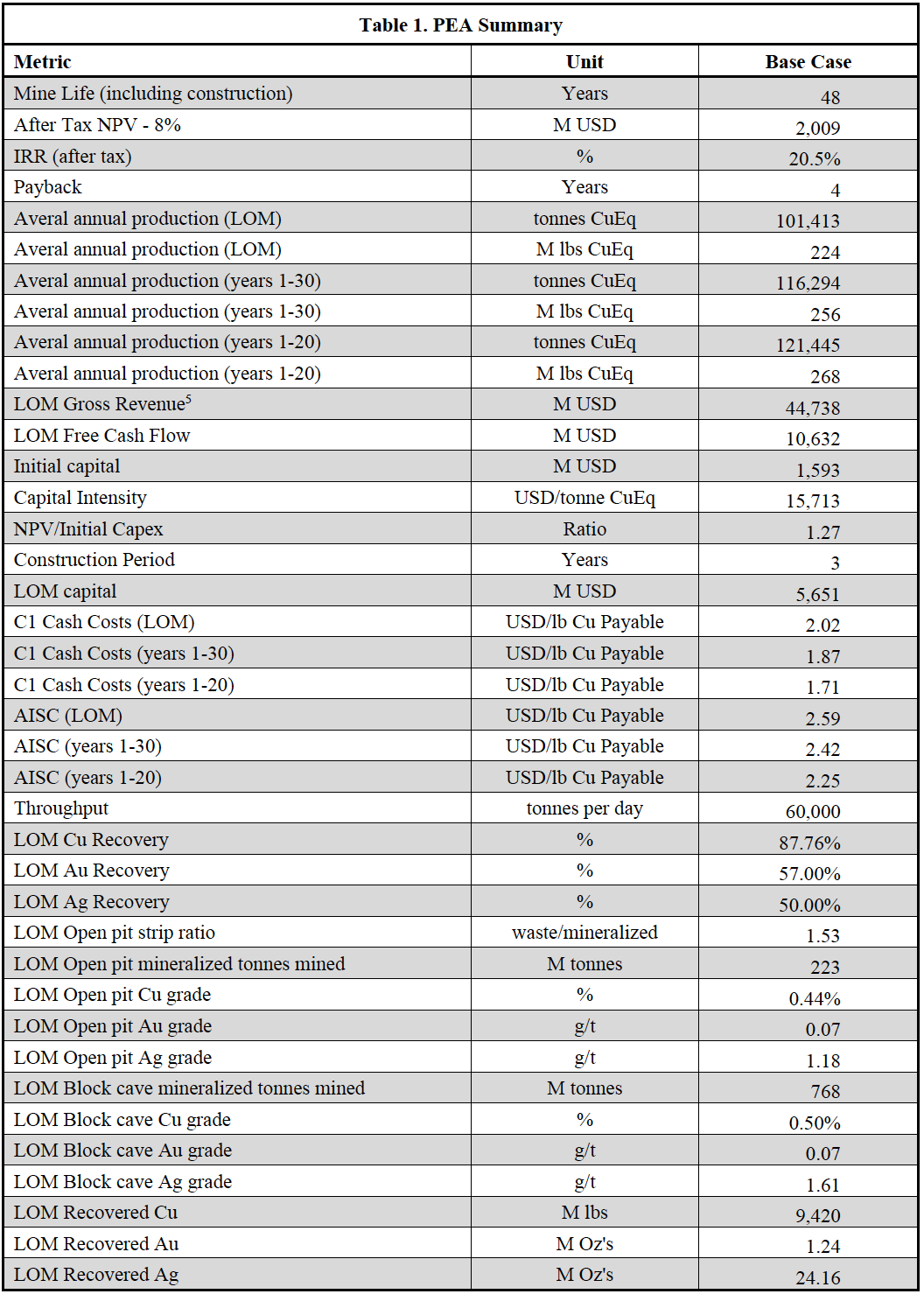

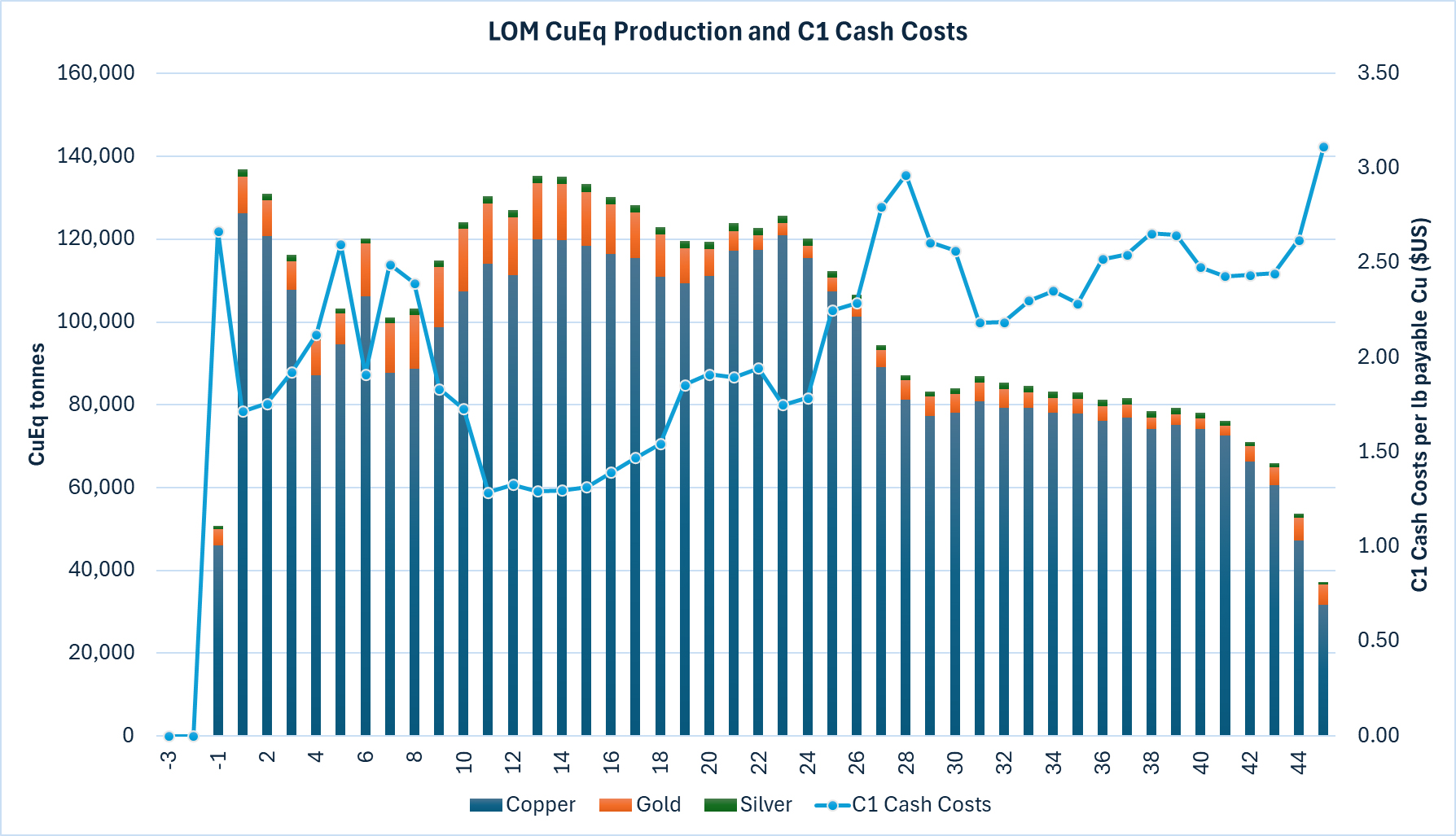

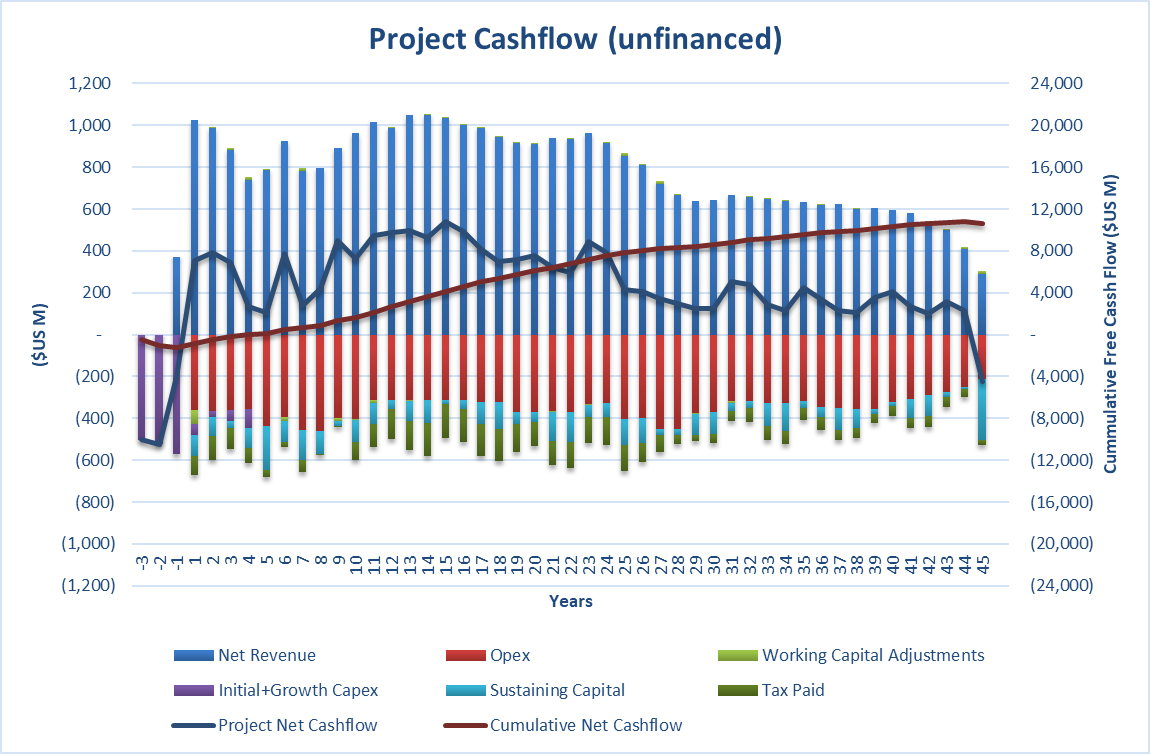

The PEA envisions a combination of open-pit and underground mining, followed by processing via a conventional copper flotation circuit having a nameplate processing capacity of 60,000 tonnes per day. This results in a mine life of 48 years with an average annual production of 102,742 CuEq tonnes for LOM, 116,539 tonnes CuEq for the first 30 years, and 121,748 CuEq tonnes for the first 20 years. Table 1 presents key operating and financial highlights from the PEA, using base study case assumptions of $4.35/lb Cu, $2,500/oz Au and $27/oz Ag. Figure 1 displays annual CuEq production for the LOM, while Figure 2 displays projected cash flows.

Figure 1 – LOM CuEq Production and C1 Cash Costs

Figure 2 – Project Cash Flows

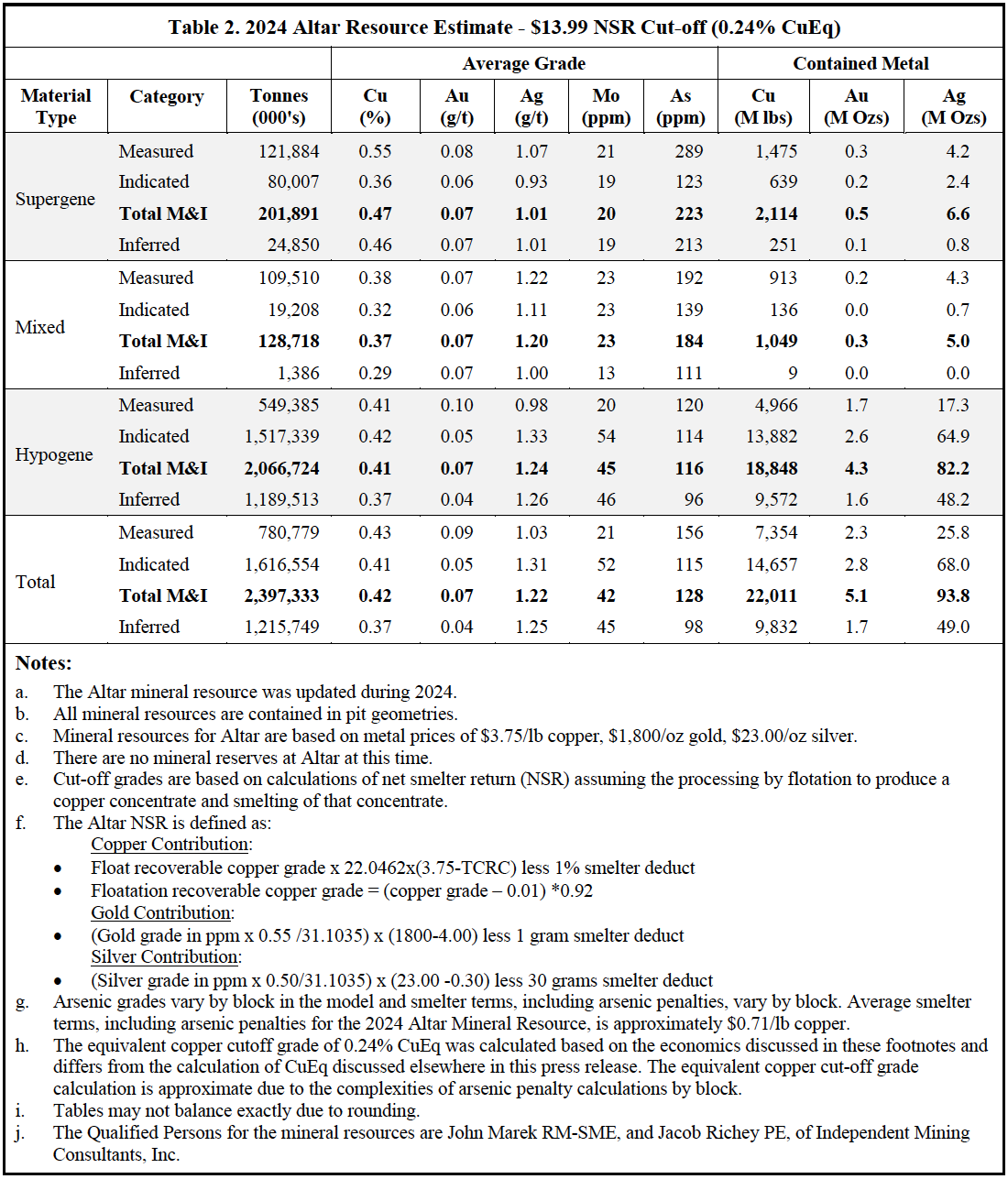

Mineral Resource Estimate

On November 25, 2024, the Company announced an updated mineral resource estimate (“MRE”) for the Altar project (see Table 2). The PEA is based on the MRE; however, the PEA production profile is based on a subset of the MRE, utilizing different metal prices, operating costs, and mining methods.

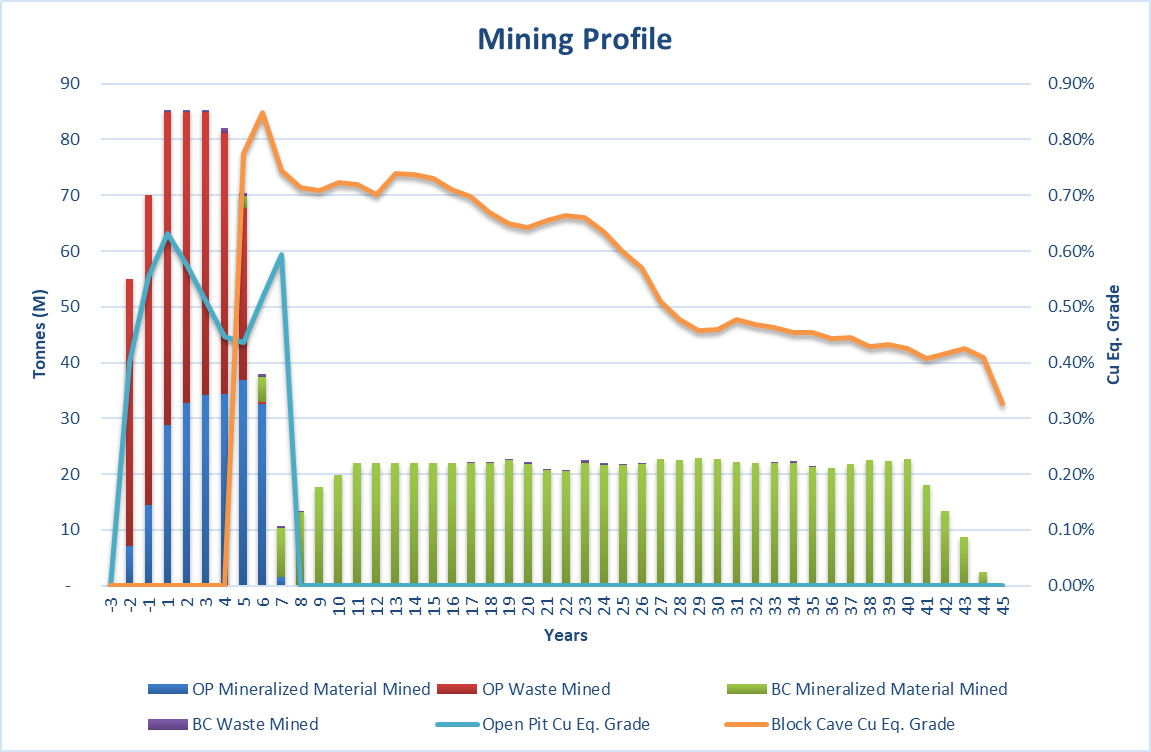

Mining

The proposed mining method is divided into open-pit mining for the near-surface part of the deposit and underground caving for the deeper parts. The open pit will use well-known truck and shovel operations with 12.5-m bench intervals. Haul trucks will be used for hauling mineralized material to the crushing plant and long-term stockpile facilities. Waste rock will be hauled to the closest waste rock storage facility. Underground operations will handle material in bulk using well established block caving methods. Open-pit mining will occur during the first 9 years of operation (in the Altar Central area), while underground development is underway. The mining profile for the project can be seen in Figure 3.

Open pit mining operations will use a smaller-scale equipment fleet that includes 8 m3 hydraulic excavators and 100t capacity SANY haul trucks to allow for narrower bench phases and haul roads, steeper pit slopes, which will facilitate getting into the better-grade, highest-margin mineralization sooner. Underground block cave mining will occur in three areas: Altar East, Altar United, and Altar Central (beneath the open pit). Each underground cave is divided into two lifts, an upper and lower, which will be sequenced as follows: Altar East Upper, Altar United Upper, Altar Central Upper, Altar East Lower, Altar United Lower and Altar Central Lower. Underground access to the block caving mining areas will be through a portal and conveyor drift from the south of the proposed pit (twin declines). To develop the first block cave lift at Altar East, two 3000 m declines are required plus associated development beneath the cave lift.

Figure 3. Mining profile for the LOM

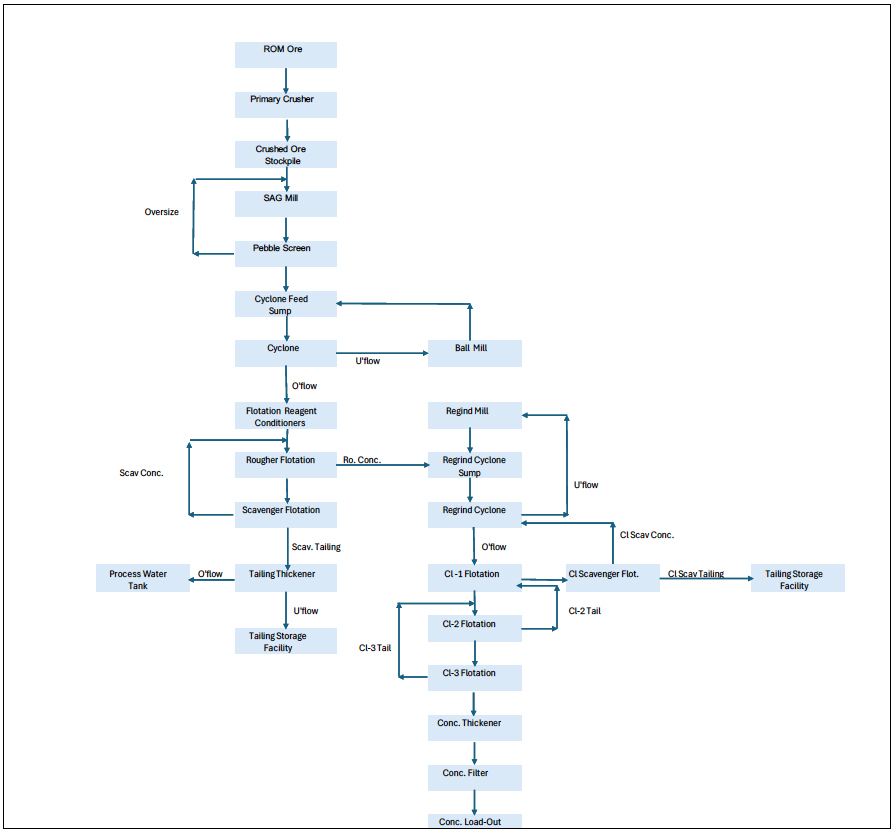

Processing

Extensive metallurgical test work has demonstrated that the contained copper and gold can be effectively recovered in a traditional flotation concentrator that would produce a single gold-bearing copper concentrate using industry-accepted technologies. The flowsheet includes primary crushing followed by grinding in a SAG (semi-autogenous grinding) mill/ball mill grinding circuit, rougher flotation, regrinding of the rougher concentrate and three stages of cleaner flotation. The concentrator would be constructed with a capacity to process 60,000 tpd and operated on a 365 day/year, 24 hour/day schedule. A simplified process flowsheet can be seen in Figure 4. LOM average recoveries for Cu, Au and Ag are 87.76%, 57% and 50% respectively. The grade of the concentrate produced is 26% for the LOM. Arsenic in the concentrate is expected to range from 0.5% to 2.2%. Aldebaran hired the CRU Group, a global leader in commodity research and market analysis, to complete a study analyzing the placement of arsenic-bearing concentrates into the marketplace, which showed that blending capacity for arsenic-bearing copper concentrates worldwide has increased materially in recent years, and penalties paid for arsenic-bearing concentrates have decreased substantially. The PEA utilizes CRU’s view on arsenic penalties.

Figure 4. Processing Circuit

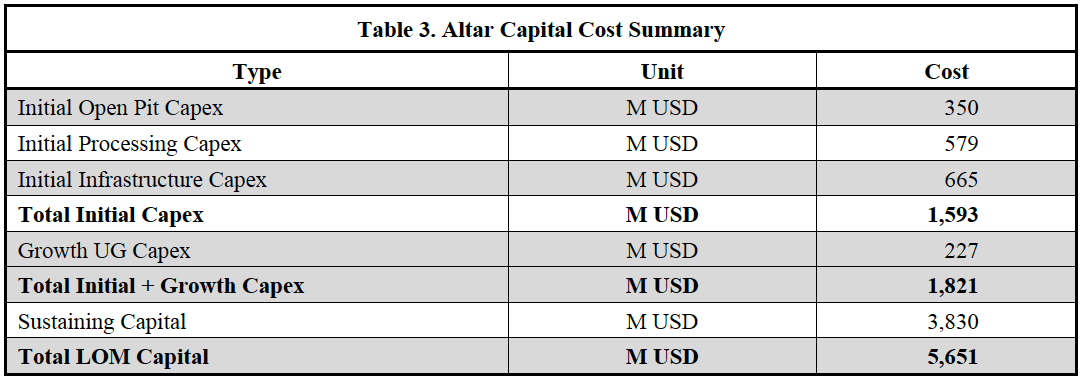

Capital and Operating Costs

The capital cost estimate prepared for the PEA includes an installation cost associated with the site infrastructure, open pit mine and concentrator plant, a growth capital associated with the installation of the block caving underground mining operation, and the sustaining capital associated with the production plan. The LOM summary of capital is presented in Table 3, while the capital profile for the LOM is presented in Figure 5.

Figure 5. Capital Profile for the LOM

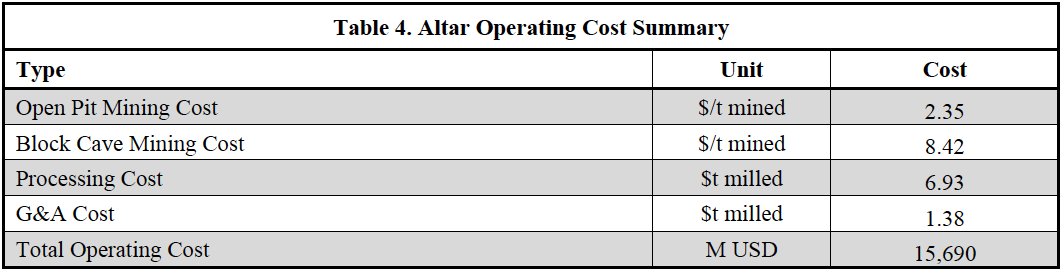

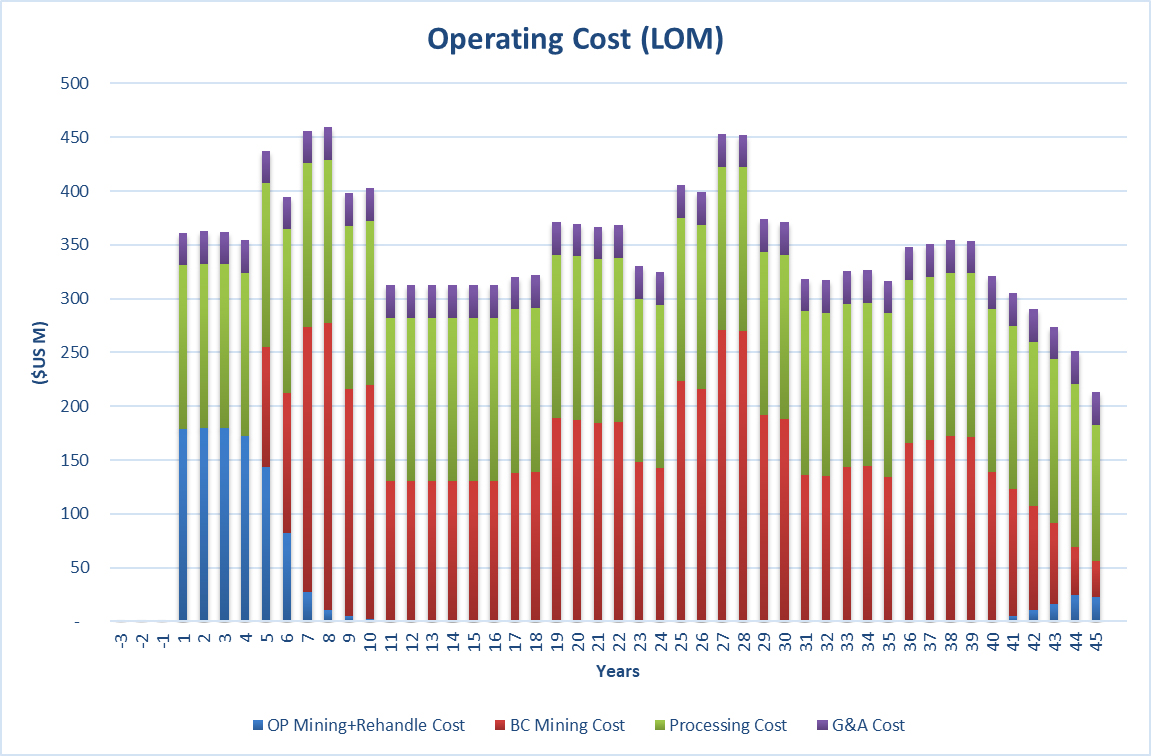

Operating costs were estimated for the open pit mining operation, block caving mining operation, the concentrator processing operation, and G&A. A summary of the estimated operating costs is presented in Table 4. The buildup of LOM C1 cash costs and AISC can be found in Tables 5 and 6, while operating costs by year can be found in Figure 6.

Figure 6. Operating Cost by Year

Infrastructure

The Altar project includes on-site infrastructure such as earthworks development, crushing and process plant facilities as well as ancillary buildings such as camp, warehouses and workshops, on-site roads, water management systems, and site electrical power facilities.

Off-site infrastructure includes a site access road, plant roads, water supply, power supply (power transmission line), two waste rock storage areas, the tailings storage facility, and surface water management structures.

Water use for the project assumes use of surface runoff water, pit dewatering wells, water supply wells within 25 km from the concentrator, with additional water supplied from surface sources.

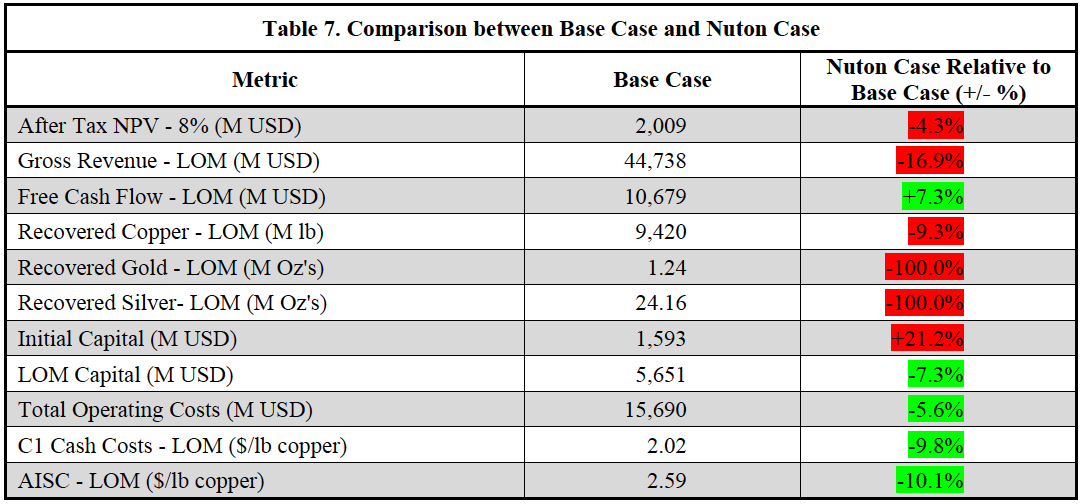

Nuton, a Rio Tinto venture, Scenario

On November 7, 2024, Aldebaran announced that it had entered an agreement with Nuton Holdings ltd. (“Nuton”), whereby Aldebaran would grant Nuton the option to acquire a 20% stake in the Altar project (see Company press release dated November 7, 2024). As part of that agreement, Aldebaran agreed to include a case in the PEA (“Nuton Case”) utilizing the Nuton® Technology, a suite of proprietary sulphide leaching technologies, as a potential alternative to the base case concentrator scenario reported above (“Base Case”). Nuton® Technology provides the potential to leach both primary and secondary sulphides, providing an alternative processing option for the Altar project. In addition, the Nuton Case provides significant other benefits, such as eliminating the need for a tailings dam, providing a smaller environmental footprint, lower overall energy consumption and lower water consumption than conventional sulphide mineralization treatment processes. Moreover, producing copper cathode on site would eliminate downstream treatment and refining costs, deleterious elements’ penalties, simplify logistics and would provide a finished product at site saleable to the market.

As a result of the work completed in the Phase 1 Nuton® Technology test work program (see Company press release dated November 7, 2024, for details), Nuton has estimated ultimate copper extraction and copper recovery after a 450-day leach cycle for each material type at Altar. The results of this analysis estimate copper extraction from hypogene, mixed and supergene material at 86%, 88% and 91%, respectively. Nuton applies a discount factor of 92% to allow for inherent inefficiencies in the scale up to a commercial heap leach and has, therefore, estimated copper recoveries from hypogene, mixed and supergene material at 79%, 81% and 84%, respectively.

The Nuton Case in the PEA utilizes the same mine plan as the Base Case, due to the use of an overall elevated cutoff grade for both cases; however, it utilizes Nuton® Technology, a bio-leach heap leaching process targeting the leaching of primary and secondary copper sulfide minerals and has been designed to process 60,000 tpd, matching the Base Case throughput. Material will be crushed and processed using a conventional lined heap leach pad and combined with a standard SX/EW facility will produce saleable copper cathode onsite. Aldebaran currently does not have a commercial agreement with Nuton to deploy Nuton® Technology at Altar and there is no guarantee an agreement will come to fruition. For comparative purposes, the Nuton Case does not include project costs associated with licensing and Nuton® Technology services at the Altar Project.

To demonstrate the Nuton Case, the variance percentage relative to the Base Case is included here for selected key production and financial metrics. The results of the Nuton Case can be found in Table 7. Measurable contributors to capital spend include a Tailings Storage Facility (TSF) for the Base Case and a Heap Leach Pad (HLP) for the Nuton Case. The Nuton case shows higher initial capital requirements due to the need for more infrastructure from the start-up (e.g. full-sized ponds) compared to a TSF. However, LOM capex in the Nuton Case is lower, as TSF requires higher sustaining capex to reach final capacity. Additionally, at this time, precious metals such as gold and silver cannot be recovered with Nuton® Technology, whereas they are recovered in the Base Case. Timing of capital and revenue from copper equivalent reduces the NPV for the Nuton Case, but lower total capital and lower operating C1 and AISC costs allow for a higher Free Cash Flow in the Nuton Case.

Green represents metrics where the Nuton case improved over the base case whereas red represents metrics where the base case was more attractive than the Nuton case

Opportunities

Several opportunities to potentially unlock additional value remain to be evaluated, including:

- Installation of a molybdenum circuit in the later years of the mine when higher-grade molybdenum is encountered in the lower block caves

- Additional metallurgy to potentially improve copper recoveries

- Combined concentrator and Nuton® Technology scenario

- Processing of concentrate on-site rather than shipping to a smelter

- Filtered tailings storage

- Producing a pyrite concentrate from the pyrite-rich waste rock, that could be used in the Nuton Case

- Upsizing the daily production rate and copper output with better metal prices

Next Steps

- The 2025/2026 field season is underway, with four drill rigs currently being mobilized to site

- Additional infill drilling to convert inferred resources to the measured and indicated categories

- Preparation to apply for inclusion under Argentina’s RIGI benefits

- Produce an updated mineral resource estimate based on the infill drilling completed in 2024-2025 and the to-be-completed 2025-2026 infill drilling (resource conversion)

- Geotechnical drilling within the PEA open pit and underground block caves

- Geotechnical drilling within the PEA tailings storage facility

- Lab-based geotechnical stress and strain test work

- Acid Based Accounting (ABA) test work

- Drilling additional water wells and conducting additional pump tests for water balance studies

- Continue environmental monitoring studies

Study Notes

Aldebaran retained SRK Consulting Inc. as lead consultants, with Knight Piesold as a subcontractor.

The PEA is preliminary in nature, as it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves and do not have demonstrated economic viability.

Webinar

For more context, please join the Company in a live event on Friday, October 31 at 11:00 am EST / 8:00 am PDT.

Click here to register: https://6ix.com/event/aldebaran-resources-presents-pea-results.

Qualified Person

The scientific and technical data contained in this news release has been reviewed and approved by Dr. Kevin B. Heather, B.Sc. (Hons), M.Sc, Ph.D, FAusIMM, FGS, Chief Geological Officer and director of Aldebaran, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

Notes

- Assumes commercial production begins in year 1 after 3 years of construction. 20- and 30-year averages calculated starting in year 1.

- CuEq calculated in the PEA study using $4.35/lb Cu, $2,500/oz Au and $27/oz Ag and is reported utilizing recoveries of 87.76% for Cu, 57% for Au, and 50% for Ag.

- Capital intensity calculated as initial capex divided by LOM average annual CuEq production.

- LME copper price, gold and silver price as of market close on October 27, 2025. The NPV calculation using spot prices was not part of the PEA report and was calculated by Aldebaran using the financial model provided by SRK.

- Before TC/RCs, payabilities and transport.

ON BEHALF OF THE ALDEBARAN BOARD

(signed) “John Black”

John Black

Chief Executive Officer and Director

Tel: +1 (604) 685-6800

Email: info@aldebaranresources.com

Please click here and subscribe to receive future news releases: https://aldebaranresources.com/contact/subscribe/

For further information, please consult our website at www.aldebaranresources.com or contact:

Ben Cherrington

Manager, Investor Relations

Phone: +1 347 394-2728 or +44 7538 244 208

Email: ben.cherrington@aldebaranresources.com

About Aldebaran Resources Inc.

Aldebaran is a mineral exploration company that was spun out of Regulus Resources Inc. in 2018 and has the same core management team. Aldebaran holds an 80% interest in the Altar copper-gold project in San Juan Province, Argentina. The Altar project hosts multiple porphyry copper-gold deposits with potential for additional discoveries. Altar forms part of a cluster of world-class porphyry copper deposits which includes Los Pelambres (Antofagasta Minerals), El Pachón (Glencore), and Los Azules (McEwen Copper). In November 2024 the Company announced an updated mineral resource estimate for Altar, prepared by Independent Mining Consultants Inc. and based on the drilling completed up to and including the 2023-24 field season (independent technical report prepared by Independent Mining Consultants Inc., Tucson, Arizona, titled “Technical Report, Estimated Mineral Resources, Altar Project, San Juan Province, Argentina”, dated December 31, 2024 – see news release dated November 25, 2024).

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains “forward-looking information” or forward-looking statements” within the meaning of Canadian and United States securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the Altar project as a profitable project for the Company, the scale, throughput, resources, projected production and projected profitability of the Altar project, timeline for the completion of a mineral resource update, a pre-feasibility study, and the proposed spin-out of Centauri Minerals, projected gold prices and other assumptions, projected economics, including NPV, IRR, cash costs, AISC and payback period, are forward-looking. Generally, the forward-looking information and forward looking statements can be identified by the use of forward looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, “will continue” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this news release.

Forward looking information and forward looking statements, while based on management’s best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Aldebaran to be materially different from those expressed or implied by such forward-looking information or forward looking statements. Although Aldebaran has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements. The Company has and continues to disclose in its Management’s Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking information and forward-looking statements and to the validity of the information, in the period the changes occur. The forward-looking statements and forward-looking information are made as of the date hereof and Aldebaran disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements or forward-looking information contained herein to reflect future results. Accordingly, readers should not place undue reliance on forward-looking statements and information.

From vaccines to copper: a biologist’s unlikely journey into mining

Peter Lavrencic owns a front-row seat to mining history in the making. As Nuton heads towards producing first copper at Gunnison Copper Corp.’s Johnson Camp Mine in Arizona, Peter, Nuton’s Biotechnology Lead, plays a key role in the biological process behind a major milestone: the first industrial-scale demonstration of the proprietary Nuton® Technology.

With first Nuton Copper expected in late 2025, this moment marks a turning point for the venture—validating the Nuton Technology’s proprietary process at scale and paving the way for commercial deployment and a new era in sustainable copper production.

A biochemist’s path to bioleaching

Peter says he’s had an untraditional career path crossing from pharmaceuticals to mining. “It’s incredible how you can transfer your knowledge across what seem like unrelated industries.” He previously worked in the manufacturing, development, and regulatory affairs of vaccines and biological medicines in the pharmaceutical industry. As an ever-curious biochemist and biologist, Peter was so drawn to Nuton’s breakthrough in environmentally conscious copper mining technology that he swapped his career in pharma for one in cutting-edge copper.

Today, Peter’s work bridges the fields of biology and mining. Instead of growing biological medicines in bioreactors for pharmaceuticals, he’s applying similar science to bioleaching in the mining sector. “Mining has historically been seen as a ‘polluting and non-environmentally friendly’ industry, but this new biological process of bioleaching is a positive shift toward a cleaner, more sustainable method whilst delivering a critical resource for our society.”

Microbes that mine: the science behind the heap

Nuton’s approach to copper mining is game-changing. “Our process is more cost-effective and better for the environment compared to traditional methods mining this ore type.” Moving away from traditional, high-energy-use methods, the Nuton® Technology employs a proprietary biological process using specially curated microorganisms to extract copper from ore.

Massive bioreactors serve as breeding grounds where Nuton’s microbes are born to mine. The facility encompassing the bioreactors – the BIGF for short – is the star bioreactor at Johnson Camp Mine where the microbial magic happens.

“It’s like a maternity ward of microbes, where we provide the incentive and conditions to multiply the right microbes at a maximal rate,” Peter says. These microbes work by “eating” ore components such as iron in the ore, which through a series of chemical reactions releases copper in a process that’s as fascinating as it is revolutionary.

“In the pharmaceutical industry, we grow cells and use their components for the medicine. What we’re doing in mining is somewhat similar. We’ve designed a special composition of microbes to grow in large bioreactors and the cells themselves are the ‘medicine’ for our heap.”

Scaling up sustainably

Peter’s focus is on optimizing the biological side of the process – ensuring the right diversity of microbes is fine-tuned to perform reliably at scale. This is no small feat: the microbes must thrive in harsh mining environments, adapt to changing conditions, and work together in complex chemical reactions.

“People have been mining copper for centuries. Much of the easy-to-mine copper has been mined out. Additionally, the world is more conscious of the environment.” Peter proudly adds that the Nuton Technology isn’t just about producing copper – it’s about doing it more sustainably. These microbes consume carbon dioxide as they work, and water is continuously recycled — turning mining’s biggest environmental challenges into solutions.

Johnson Camp: a launchpad for the future of copper mining

When Peter joined Nuton, everything was still on paper for JCM. Today, Johnson Camp Mine is a buzzing launching pad, with key infrastructure connected and ready for commissioning – the final step before copper production begins.

For him, the biggest reward of the project has been seeing it come off the paper into real life, and the collaboration taking place across Nuton’s team to make this a reality. From mining engineers and metallurgists to AI specialists, the Johnson Camp journey has been powered by a diverse group of experts to bring the Nuton Technology to life.

The learnings and successes from Johnson Camp will inform future deployments across other copper-rich regions, from Arizona to South America.

“I’m a scientist, so new things excite me. I can genuinely use my skills in a unique way.” Peter is thrilled to witness years of biological development come to life at Johnson Camp Mine. In an industry that’s remained largely unchanged for centuries, copper mining is now being revolutionized by the power of biology.

America’s Newest Copper Producer Delivers Ahead of Schedule

Phoenix, Arizona–(Newsfile Corp. – September 3, 2025) – Gunnison Copper Corp. (TSX: GCU) (OTCQB: GCUMF) (FSE: 3XS0) (“Gunnison” or the “Company”) is thrilled to announce the first production of pure copper cathode from its fully-operational Johnson Camp Mine (“JCM”) in southeast Arizona commenced in the last week of August 2025, establishing Gunnison as the newest American Copper Producer.

Following the successful start-up of the solvent extraction (SX) and electrowinning (EW) circuit (announced August 11, 2025), copper cathode is now officially in production from run-of-mine (ROM) ore. Gunnison has achieved this critical milestone ahead of schedule, producing Made-in-America copper for domestic sales.

“This is an incredible moment for Gunnison and for U.S. copper supply. To bring Johnson Camp into production ahead of schedule and with an excellent health and safety record is an achievement we’re extremely proud of,” states Stephen Twyerould, Chief Executive Officer and President. “Even more exciting is that we are now producing 100% American-made copper at a time when our nation needs it most. We extend our gratitude to our dedicated team, valued stakeholders, and especially Nuton LLC, a Rio Tinto venture, whose critical support made this possible.”

Nuton is a key strategic and financial partner to Gunnison, supporting the restart of copper production at JCM. With exclusive rights to deploy its proprietary leaching technologies, Nuton is enabling a more sustainable and economically viable path for copper recovery at JCM.

“We congratulate Gunnison Copper and its dedicated team on this important milestone and are proud to support the company’s efforts in revitalizing mining in Arizona,” added Adam Burley, Nuton’s Chief Executive Officer. “We look forward to first copper production using Nuton technologies later this year, unlocking copper through innovation and partnership.”

Key Highlights of the Johnson Camp Mine Commissioning:

- First copper production achieved ahead of schedule, firmly establishing Gunnison as America’s newest copper producer.

- Exceptional safety performance: Commissioning of the ROM copper production circuit completed without incident, underscoring Gunnison’s uncompromising commitment to health and safety excellence.

- Critical U.S. supply: New domestic production strengthens American energy independence, national defense, and advanced manufacturing capabilities.

- Partnerships: Fully funded and supported by Nuton LLC, a Rio Tinto venture, and awarded US$13.9 million in 48C tax credits from the Department of Energy (see Gunnison press release dated January 16, 2025 for additional details).

- Growth trajectory: Ramp-up in progress toward the name plate plant capacity of 25 million pounds of finished copper cathode annually.

ABOUT GUNNISON COPPER

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt.

Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3 Billion, IRR of 20.9%, and payback period of 4.1 years. It is being developed as a conventional operation with open pit mining, heap leach, and SX/EW refinery to produce finished copper cathode on-site with direct rail link.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the conclusions reached in the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

In addition, Gunnison’s Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

Other significant deposits controlled by Gunnison in the district, with potential to be economic satellite feeder deposits for Gunnison Project infrastructure, include Strong and Harris, South Star, and eight other deposits.

For additional information on the Gunnison Project, including the PEA and mineral resource estimate, please refer to the Company’s technical report entitled “Gunnison Project NI 43-101 Technical Report Preliminary Economic Assessment” dated effective November 1, 2024 and available on SEDAR+ at www.sedarplus.ca.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of the Company is a Qualified Person as defined by NI 43-101. Dr. Twyerould has reviewed and is responsible for the technical information contained in this news release.

For more information on Gunnison, please visit our website at www.GunnisonCopper.com.

ABOUT NUTON

Nuton is an innovative venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leaching technologies and capability. Nuton has the potential to economically unlock copper from hard-to-leach ores, including primary sulfides and, in doing so, increase domestic production of critical minerals to support the energy transition. Nuton technologies can achieve market-leading recovery rates and boost copper production in new, ongoing and historical operations, increasing resource utilization and maximizing value.

With significantly lower energy and water needs than conventional concentrating and smelting, and the ability to produce copper cathode at the mine site, Nuton offers a reliable source of domestically produced copper, with a short mine-to-metal supply chain and the ambition to set industry-leading ESG credentials.

One of the key differentiators of Nuton is the ambition to produce the world’s lightest environmental footprint copper while having at least one Positive Impact at each of its deployment sites, across its five pillars: water, energy, land, materials and society.

For more information, please visit https://nuton.tech.

For further information regarding this press release, please contact:

Gunnison Copper Corp.

Concord Place, Suite 300, 2999 North 44th Street, Phoenix, AZ, 85018

Melissa Mackie

T: 647.533.4536

E: info@GunnisonCopper.com

www.GunnisonCopper.com

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” concerning anticipated developments and events that may occur in the future. Forward-looking information contained in this news release includes, but is not limited to, statements with respect to: (i) the intention to deploy the Nuton® technology at the Johnson Camp mine and future production therefrom; (ii) the continued funding of the stage 2 work program by Nuton; (iii) the details and expected results of the stage two work program; (iv) timelines for future production and production capacity from the Company’s mineral projects; (v) expectations regarding the timing and amount of 48C tax credits; (vi) the results of the preliminary economic assessment on the Gunnison Project; and (vIi) the exploration and development of the Company’s mineral projects.

In certain cases, forward-looking information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved” suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, Nuton will continue to fund the stage 2 work program, the availability of financing to continue as a going concern and implement the Company’s operational plans, the estimation of mineral resources, the realization of resource and reserve estimates, , copper and other metal prices, the timing and amount of future development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs (including the price of acid), the availability of labour, material and acid supply, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks related to the Company not obtaining adequate financing to continue operations, Nuton failing to continue to fund the stage 2 work program, the breach of debt covenants, risks inherent in the construction and operation of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not be sustained at the Gunnison Copper Project, risks related to the delay in approval of work plans, variations in mineral resources and reserves, grade or recovery rates, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products, risks related to current global financial conditions, risks related to current global financial conditions on the Company’s business, uncertainties inherent in the estimation of mineral resources, access and supply risks, risks related to the ability to access acid supply on commercially reasonable terms, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the construction or mining process, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264914